My best car insurance blog 6249

Some Ideas on Safeco Insurance - Quote Car Insurance, Home Insurance ... You Need To Know

If you're new to the world of car insurance coverage, you may be questioning: What are cars and truck insurance coverage premiums? Your premium is what you pay your insurance coverage company in exchange for automobile insurance coverage each coverage duration - insured car. In this article, we at the House Media reviews team will review what cars and truck insurance premiums are, how they're determined, ways to decrease your payments and more. cheaper car.

Automobile insurance coverage premium introduction A vehicle insurance premium is another word for your cars and truck insurance coverage expense. It is the amount you have to pay to keep your automobile insurance valid.

Cars and truck insurance coverage quote vs. cheaper auto insurance. premium A car insurance coverage quote is not the exact same thing as a premium. You might reach out to numerous companies and get various prices for automobile insurance coverage. Those are quotes. The premium is the quantity you pay monthly (or 6 or twelve months) as soon as you start a policy.

This is due to the fact that insurance provider get more info that can affect your rate when you start the policy. The rate could alter if you didn't enter your cars and truck's VIN into the quote kind or if you didn't include all household drivers at that time. Or, your rate might alter if the business uses a credit-based insurance rating to compute threat after you received the quote - accident.

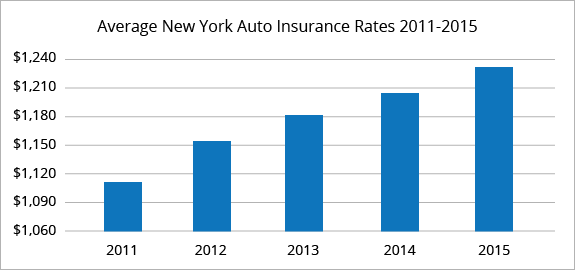

Your premiums contribute to a local insurance swimming pool that is impacted by state regulations and total claims. On the other hand, if your state introduces new legislation to manage insurance coverage expenses, you may see a lower rate in your next policy duration.

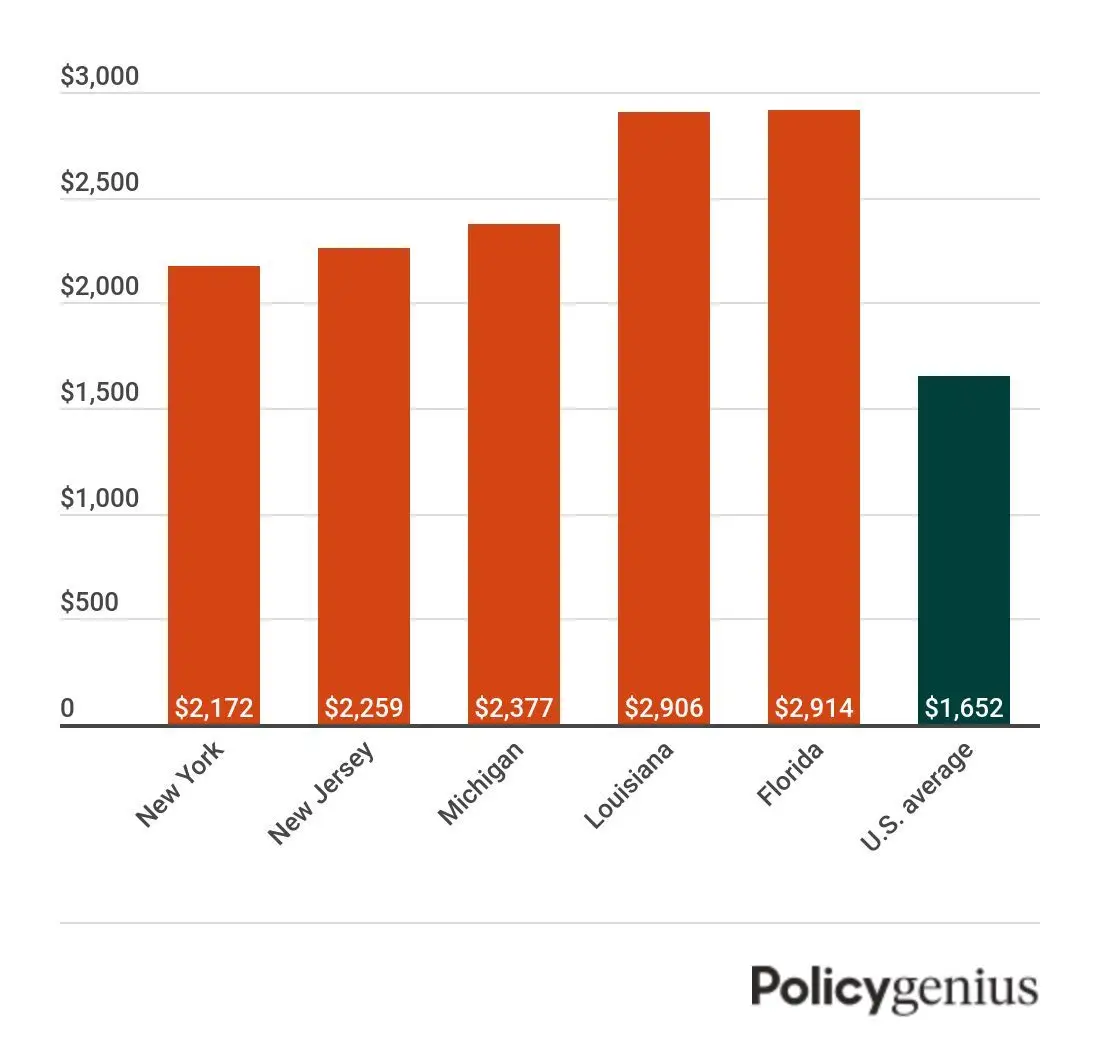

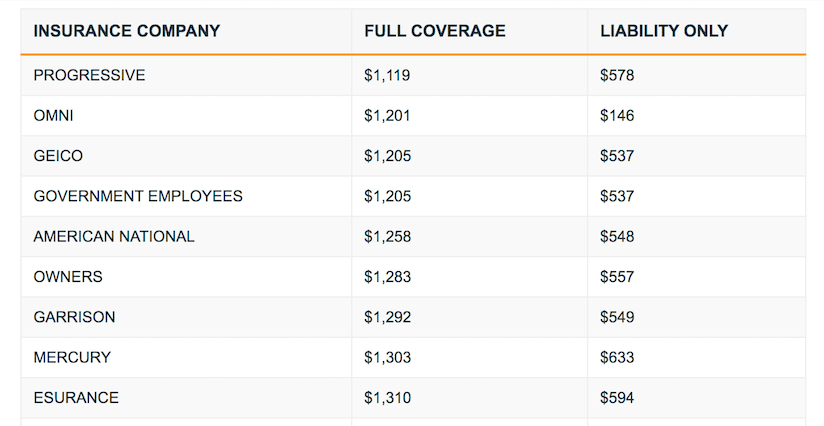

There is no basic automobile insurance coverage premium for every chauffeur. These costs are extremely individualized, and each insurer determines vehicle insurance coverage premiums in a different way. The majority of consider the following when setting rates: What does an automobile insurance coverage premium cost? Our group evaluated complete coverage rate estimates for 35-year-old chauffeurs with great credit and driving records from a variety of vehicle insurer.

Take a driver security course: Lots of insurance companies offer discount rates for completing a state-approved driver safety program. Choose usage-based insurance coverage, if it might benefit you: A number of insurance providers offer usage-based discount programs.

Getting My Auto Insurance Premium Comparisons - Mass.gov To Work

Our methodology Since consumers rely on us to supply objective and accurate info, we produced an extensive rating system to formulate our rankings of the finest cars and truck insurance companies. We collected information on lots of vehicle insurance companies to grade the business on a wide variety of ranking aspects. The end result was a total score for each service provider, with the insurance companies that scored the most points topping the list. cheap insurance.

Protection (20% of total score): Business that use a variety of choices for insurance protection are more most likely to fulfill customer requirements - insurance companies. Track record (20% of overall score): Our research study group considered market share, ratings from market professionals and years in business when providing this rating. suvs. Availability (20% of total score): Vehicle insurance provider with greater state availability and few eligibility requirements scored highest in this category.

Vehicle insurance coverage is essential to safeguard you economically when behind the wheel.!? Here are 15 methods for conserving on vehicle insurance coverage costs.

Lower automobile insurance rates might also be available if you have other insurance coverage policies with the same company. Preserving a safe driving record is key to getting lower vehicle insurance coverage rates. How Much Does Car Insurance Coverage Expense? Car insurance expenses are different for each chauffeur, depending upon the state they reside in, their choice of insurance provider and the kind of protection they have (low-cost auto insurance).

The numbers are fairly close together, suggesting that as you budget plan for a new cars and truck purchase you may need to include $100 or two each month for automobile insurance. Keep in mind While some things that affect automobile insurance coverage rates-- such as your driving history-- are within your control others, expenses might likewise be affected by things like state guidelines and state mishap rates - insurance.

https://www.youtube.com/embed/-tpgJiWQgOA

When you know how much is car insurance for you, you can put some or all of these tactics t work. cheapest auto insurance. 1. risks. Benefit From Multi-Car Discounts If you get a quote from an automobile insurance coverage company to insure a single automobile, you may end up with a greater quote per vehicle than if you asked about guaranteeing several motorists or cars with that company (auto insurance).

The Ultimate Guide To Getting A Driver License: Mandatory Insurance - Dol.wa.gov

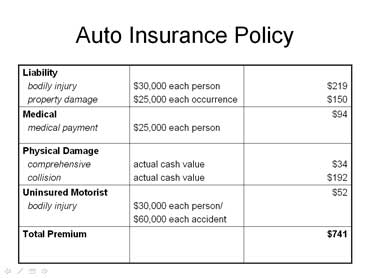

It is possible to buy more coverage protection than the minimum level of protection needed (cheaper). Liability insurance coverage secures you just if you are accountable for a mishap and spends for the injuries to others or damages to their home (insurance). It does not supply coverage for you, your guests who are your resident family members, or your property (insurers).

What other types of protection can I buy? Chauffeurs who wish to secure their cars against physical damage can need to buy: This coverage is for damage to your lorry resulting from a collision, regardless of who is at fault (cars). It offers repair work of the damage to your vehicle or a monetary payment to compensate you for your loss. auto insurance.

- This pays for treating injuries to you and your guests without regard to fault - cheaper cars. It also pays for dealing with injuries resulting from being struck as a pedestrian by a motor car. What is a deductible? Your automobile insurance deductible is the quantity of cash you should pay out-of-pocket prior to your insurance coverage compensates you. insurance companies.

You have a Subaru Wilderness that has Crash Protection with a $1,000 deductible. In this circumstance, you would pay the body shop $1,000 - low-cost auto insurance.

As soon as you have met your $1,000 deductible the insurance business will pay the remaining $5,500. cheaper car insurance. How does my deductible impact the cost of my insurance coverage? Typically, the lower your deductible, the greater the cost of your insurance will be - cars. The greater your deductible is, the lower the expense of your insurance coverage will be (perks).

How do I buy car insurance? When buying insurance, the Department of Insurance coverage suggests that you look for the recommendations of a qualified insurance expert. There are three kinds of specialists that generally sell insurance coverage: Independent agents: can offer insurance coverage from several unaffiliated insurance companies. Unique representatives: can only offer insurance from the company or group of companies with which they are associated.

Despite what type of professional you pick to use, it is important to confirm that they are licensed to perform service in the State of Nevada. auto insurance. You can check the license of an insurance coverage professional or company here (cheap). Remember Constantly confirm that an insurance company or agent are accredited prior to providing them individual info or payment. vehicle.

Getting My The Best Car Insurance In Canada: Your Complete Guide To Work

These aspects consist of, but are not restricted to: Driving record Claims history Where you live Gender and age Marital Status Make and design of your lorry Credit Nevada has among the most competitive and healthy car insurance coverage markets in the country. Shopping for insurance might allow you to attain competitive pricing.

https://www.youtube.com/embed/YbUboX3aBfE

To find out about making use of your credit details by insurer read our Often Asked Questions About Credit-Based Insurance Coverage Scores.

Indicators on How To Maintain Low Car Insurance Rates - Nationwide You Should Know

Once your credit score is raised, you might be able to get a more affordable policy from a various supplier or the one that you currently work with. car. Look Into Insurance coverage Discounts Several automobile insurance coverage companies offer substantial discounts to their clients. vehicle.

As you can see, many of the discount rates differ based on the specific private getting a discount, so it is best to call the insurer to learn what your particular discount rates would be. cars (laws). trucks. trucks. In addition to the discounts listed below, some insurance business offer a discount rate for an anti-theft device.

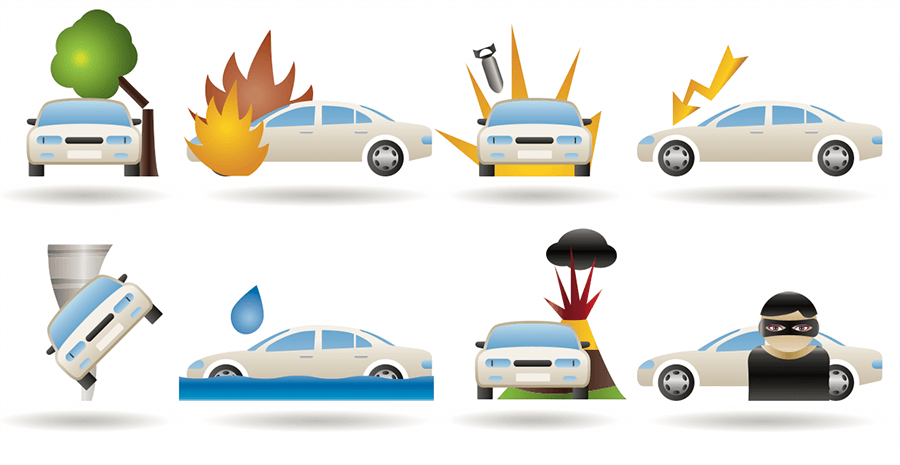

Obviously, stopping extensive coverage could expose you to heavy expenses if a natural catastrophe or vandalism affected your lorry. insurance. If you have an older cars and truck with low value that you intend to replace soon, it might be worth dropping this coverage. If you have a fairly new cars and truck that you would like to drive for much more years, then dropping this coverage is not suggested (auto).

Join A Usage-Based Automobile Insurance Program Drivers who average less than 10,000 miles a year may consider joining a usage-based insurance program - insured car. dui (cars). When you register for one of these programs, a telemetric gadget will be installed in your vehicle to calculate possible discounts based upon just how much, how well, and/or when you drive (affordable auto insurance). insure.

https://www.youtube.com/embed/Dfk-2rl3sCA

Recommended Suppliers To Lower Car Insurance After A Mishap The after-effects of a mishap is a terrific time to compare your existing auto insurance supplier's offerings to those of other leading service providers (low cost). Below, discover why we trust State Farm and Geico insurance policies to assist lower car insurance coverage after a mishap (cars).

8 Easy Facts About What Is The Average Cost Of Auto Insurance? - Moneygeek Shown

insurers dui affordable auto insurance cheapest car

insurers dui affordable auto insurance cheapest car

Other Factors, While not as prominent in the decision, there are several other variables that an insurance company might think about when identifying your rate, consisting of: Line of work, Real estate scenario, Previous insurance protection (particularly, whether there's been had a space in coverage)Driving experience, Discount qualification. low cost auto.

The ordinary car insurance expense for complete protection in the United States is $1,150 per year, or about $97 monthly (cars). No insurance plan can cover you and your car in every scenario. A 'complete protection vehicle insurance policy' plan covers you in most of them. Full insurance coverage insurance policy is shorthand for auto insurance coverage That cover not just your liability yet damages to your vehicle.

A typical complete protection insurance policy will certainly not cover you and your auto in every circumstance. There is no such thing as a "complete protection" insurance plan; it is merely a term that refers to a collection of insurance protections that not just includes obligation coverage yet crash and also extensive.

What is taken into consideration complete insurance coverage insurance policy to one driver may not be the very same as even an additional chauffeur in the exact same family. Ideally, full insurance coverage means you have insurance policy in the kinds and also quantities that are ideal for your revenue, possessions as well as take the chance of account. The factor of all kinds of cars and truck insurance coverage is to maintain you from being monetarily wrecked by an accident or incident (car).

Fees additionally differ by hundreds or even countless dollars from firm to company. That's why we always recommend, as your very first step to conserving cash, that you contrast quotes. Here's a state-by-state comparison of the average annual expense of the following protection degrees: State-mandated minimal responsibility, or, simplistic protection needed to lawfully drive a car, Complete insurance coverage responsibility of $100,000 per person harmed in a mishap you create, as much as $300,000 per accident, and also $100,000 for home damage you cause (100/300/100), with a $500 deductible for extensive as well as collision, You'll see just how much full insurance coverage automobile insurance expenses per month, as well as annually (credit).

The Buzz on New Jersey Drivers See Among Biggest Car Insurance ...

The average yearly rate for complete coverage with greater responsibility limits of 100/300/100 is around $1,150 more than a bare minimum plan. If you pick lower liability restrictions, such as 50/100/50, you can conserve however still have suitable security (cheapest car insurance). The typical regular monthly expense to boost insurance coverage from state minimum to complete insurance coverage (with 100/300/100 limitations) is concerning $97, however in some states it's a lot less, in others you'll pay more.

low-cost auto insurance dui vehicle car

low-cost auto insurance dui vehicle car

Your car, approximately its reasonable market worth, minus your insurance deductible, if you are at mistake or the other chauffeur does not have insurance policy or if it is ruined by an all-natural catastrophe or taken (comp and also accident)Your injuries and of your passengers, if you are hit by a without insurance vehicle driver, as much as the limitations of your uninsured motorist plan (uninsured driver or UM).

Full coverage cars and truck insurance policy policies have exemptions to particular events. Each complete cover insurance coverage will have a listing of exclusions, meaning products it will not cover. Racing or various other rate contests, Off-road usage, Usage in a car-sharing program, Disasters such as war or nuclear contamination, Destruction or confiscation by federal government or civil authorities, Utilizing your automobile for livery or distribution objectives; organization usage, Deliberate damages, Cold, Deterioration, Mechanical failure (typically an optional protection)Tire damages, Things taken from the car (those may be covered by your home owners or renters plan, if you have one)A rental automobile while your own is being repaired (an optional protection)Electronics that aren't permanently attached, Custom components as well as devices (some little amount may be defined in the plan, however you can generally add a motorcyclist for greater quantities)Do I require complete insurance coverage vehicle insurance coverage? You're called for to have responsibility insurance or some other evidence of economic responsibility in every state.

You, as a car owner, get on the hook personally for any kind of injury or home damages beyond the limits you picked. Your insurer won't pay even more than read more your limit. However liability protection will not pay to fix or change your auto. If you owe money on your car, your lending institution will certainly require that you acquire accident and detailed protection to safeguard its investment.

Here are some guidelines of thumb on guaranteeing any car: When the automobile is brand-new as well as funded, you have to have full insurance coverage. Keep your deductible manageable. When the automobile is settled, increase your deductible to match your offered cost savings. (Higher deductibles help reduce your costs)When you reach a point financially where you can change your car without the support of insurance policy, seriously think about going down detailed and also crash.

An Unbiased View of Car Insurance Prices - State Farm®

affordable insure insure low cost auto

affordable insure insure low cost auto

com's on-line auto insurance coverage calculator to get our referral of what automobile insurance protection you must acquire. It'll additionally recommend insurance deductible limits or if you need protection for uninsured motorist protection, medpay/PIP, as well as umbrella insurance coverage. Exactly how to obtain low-cost full insurance coverage car insurance policy? The most effective means to locate the most affordable full insurance coverage automobile insurance is to shop your protection with various insurers.

Here are a few suggestions to adhere to when shopping for economical full coverage vehicle insurance coverage: Make certain you are consistent when shopping your liability limitations. If you select in physical injury liability each, in physical injury obligation per accident and in home damage liability per accident, always shop the very same coverage degrees with other insurance firms.

These coverages are part of a complete insurance coverage package, so a costs quote will be needed for these protections. Both accident and detailed featured a deductible, so make sure always to pick the very same deductible when going shopping for protection (cheapest car insurance). Picking a higher insurance deductible will certainly push your premium lower, while a lower insurance deductible will result in a higher premium.

There are various other coverages that help comprise a complete coverage bundle. These insurance coverages vary however can include: Uninsured/underinsured motorist coverage, Accident protection, Rental repayment protection, Towing, Gap insurance policy, If you require any one of these extra protections, always pick the exact same insurance coverage levels and also deductibles (if they use), so you are contrasting apples to apples when buying a new plan.

Can I go down full coverage automobile insurance coverage? If you can handle such a loss-- that is, replace a taken or totaled car without a payment from insurance coverage-- do the mathematics on the possible cost savings as well as think about going down protections that no longer make sense.

Excitement About Car Insurance Prices - State Farm®

Dropping extensive as well as collision, she would pay concerning a year a cost savings of a year. Let's state her cars and truck deserves as the "actual cash money worth" an insurer would pay. If her cars and truck were totaled tomorrow as well as she still brought complete coverage, she would get a check for the vehicle's actual cash worth minus her insurance deductible.

Of course, the auto's worth goes down with each passing year, and so do the insurance coverage premiums. Full protection auto insurance Frequently asked question's, Just how much is complete protection insurance coverage on a new car?

Maine has the most affordable full auto insurance policy rate on the other end of the spectrum, with an ordinary premium of a year. How much is full protection insurance policy for 6 months?

If you are funding your car, your insurance company will likely call for that you lug minimal full coverage for financed car to safeguard their investment in your lorry - cheaper auto insurance. Expect you aren't carrying extensive or crash coverage and also your vehicle is ruined in a crash by an extreme climate occasion or various other risk.

vans liability car auto

vans liability car auto

Up until you own your car outright and can manage to fix or change it, if necessary, you ought to be lugging complete coverage insurance policy. What is thought about full coverage cars and truck insurance? Technically, there is no such point as a "complete insurance coverage" insurance policy. The term "complete insurance coverage" simply describes a collection of insurance policy protections that provide a wide range of securities, essentially, protecting your car in "complete. "While "full insurance coverage" can mean various things to various individuals, many motorists think about complete coverage auto insurance policy to include not only required state protections, such as obligation insurance however comprehensive and also accident coverages (cheaper).

Indicators on How Much Is Car Insurance Per Month In 2022? Get Tips For ... You Need To Know

Always ensure you are contrasting apples to apples when it involves protection degrees and deductibles (dui).

The ordinary yearly cost of automobile insurance in the united state was $1,057 in 2018, according to the current information offered in a record from the National Association of Insurance Commissioners. Understanding that statistic won't necessarily help you figure out just how much you will be paying for your own insurance coverage.

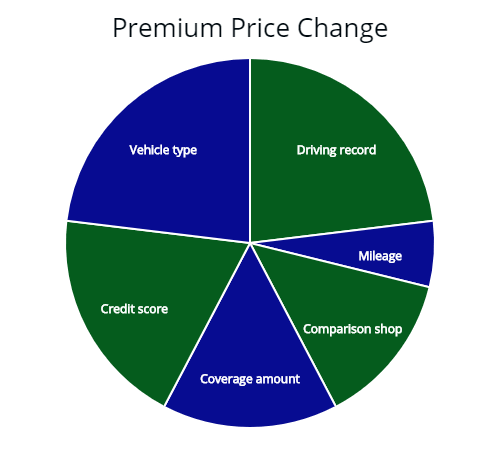

To much better recognize what you should be spending for auto insurance, it's best to find out regarding the means companies identify their prices. Keep checking out for an introduction of one of the most usual factors, and just how you can gain a few additional financial savings. Determining Typical Annual Cars And Truck Insurance Coverage Price There are a lot of factors that go right into identifying your cars and truck insurance policy rate.

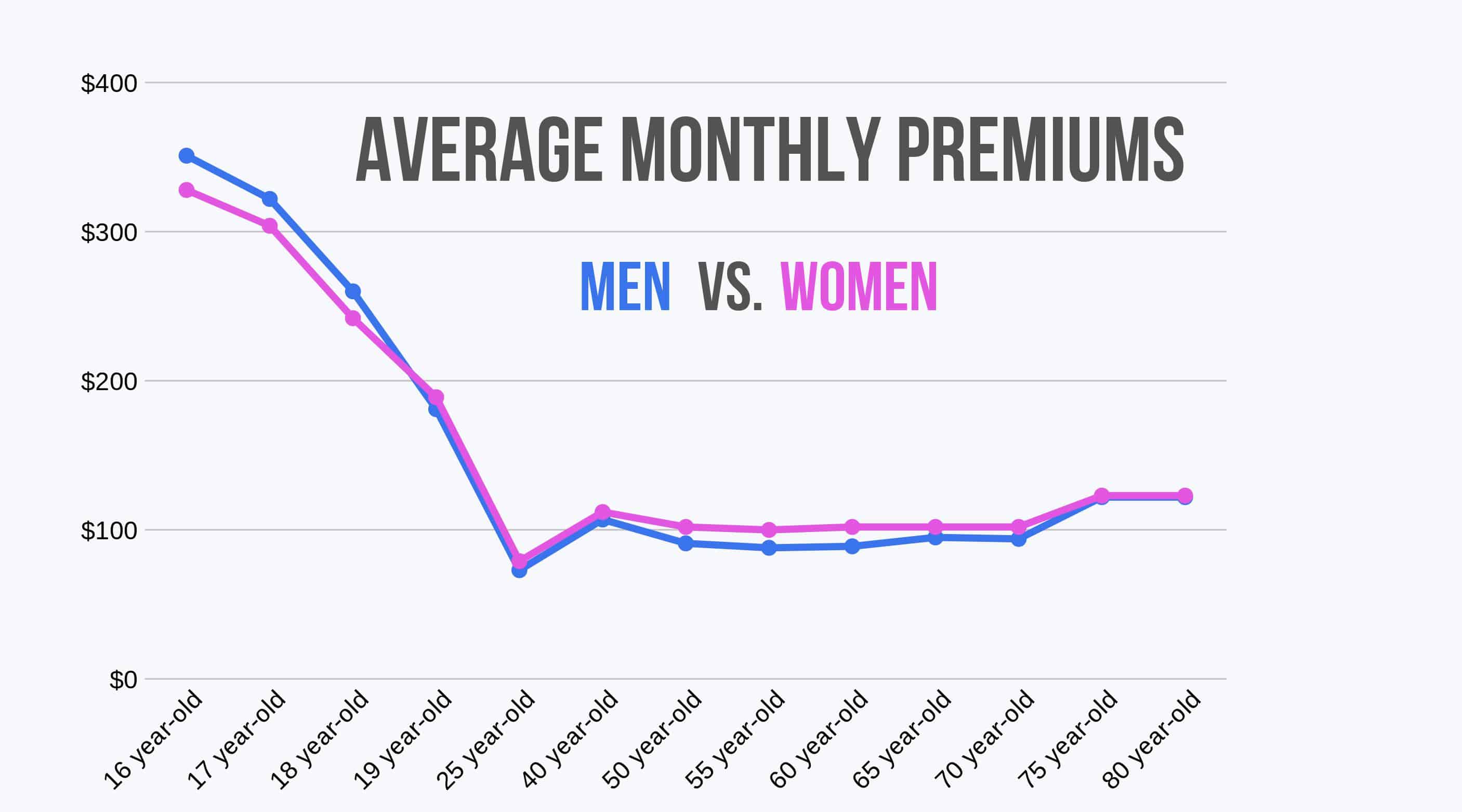

Below are some vital elements that influence the typical price of car insurance in America.: Guys are generally related to as riskier motorists than ladies - affordable. The statistics reveal that ladies have fewer DUI occurrences than guys, in addition to less collisions. When females do obtain in a crash, it's statistically much less likely to be a major crash.

Something less obvious is at play below, too; if your state mandates particular standards for car insurance that are more stringent than others, you're likely to pay more money. Michigan, for instance, calls for locals to have unlimited life time individual injury defense (PIP) for accident-related clinical costs as a component of their car insurance coverage.

What Does Car Insurance Coverage Calculator - Geico Mean?

The second the very least pricey state was Maine, followed by Iowa, South Dakota, as well as Idaho.: If you are using your cars and truck as an actual taxi or driving for a rideshare service, you will certainly need to pay even more for insurance policy, and also you may need to pay for a various sort of insurance coverage completely.

: The length of your commute, how usually you utilize your auto, why you utilize your auto, and where you park all effect your premiums. If you have a long commute, you are subjected to the threats of the road for longer. If you drive regularly, you're revealed to the risks of the road extra frequently.

Constantly make sure you are comparing apples to apples when it pertains to protection levels and also deductibles (cheaper).

The ordinary yearly price of automobile insurance coverage in the U.S. was $1,057 in 2018, according to the most recent information offered in a record from the National Association of Insurance Policy Commissioners. Nonetheless, knowing that statistic won't necessarily help you figure out just how much you will be paying for your own coverage.

To better comprehend what you ought to be spending for auto insurance policy, it's ideal to find out about the method firms determine their prices - cheap. Keep reviewing for a summary of one of the most typical components, and how you can earn a few additional cost savings. Calculating Average Yearly Car Insurance Coverage Price There are a great deal of aspects that go right into establishing your car insurance coverage rate.

What's The Average Cost Of Car Insurance In 2020? - Business ... for Dummies

insurance insurance affordable auto insurance insurance company

insurance insurance affordable auto insurance insurance company

Here are some crucial elements that affect the typical expense of car insurance in America.: Males are typically considered as riskier motorists than ladies. The data reveal that women have fewer DUI incidents than men, in addition to fewer crashes. When women do enter a mishap, it's statistically much less most likely to be a significant accident.

Something less apparent is at play below, as well; if your state mandates specific standards for cars and truck insurance that are stricter than others, you're likely to pay more money. Michigan, for instance, requires citizens to have unlimited life time individual injury defense (PIP) for accident-related medical expenditures as a part of their automobile insurance. accident.

The second least pricey state was Maine, followed by Iowa, South Dakota, as well as Idaho.: If you are utilizing your cars and truck as a real taxi or driving for a rideshare service, you will certainly have to pay more for insurance policy, and you might need to pay for a various type of insurance coverage entirely - cheapest auto insurance.

https://www.youtube.com/embed/EGmQqEsa7Kg

, just how typically you use your auto, why you utilize your vehicle, as well as where you park all impact your premiums. If you drive extra frequently, you're subjected to the dangers of the road a lot more often.

What Does Average Car Insurance Costs In Texas - Smartfinancial Do?

Insurance coverage service providers desire to see demonstrated accountable behavior, which is why website traffic accidents and citations are aspects in determining auto insurance prices. Maintain in mind that aims on your permit do not remain there forever, but for how long they remain on your driving document differs depending on the state you stay in and also the extent of the violation.

For example, a new sporting activities auto will likely be extra expensive than, state, a five-year-old sedan. If you pick a lower insurance deductible, it will lead to a higher insurance bill which makes picking a greater deductible look like a rather good offer. A greater deductible can suggest paying more out of pocket in the occasion of an accident.

What is the typical car insurance policy expense? There are a wide array of variables that influence just how much car insurance costs, which makes it hard to get an accurate idea of what the typical individual pays for cars and truck insurance coverage. money. According to the American Vehicle Association (AAA), the typical cost to guarantee a sedan in 2016 was $1222 a year, or around $102 per month.

Nationwide not just uses competitive prices, however also a variety of discount rates to help our members save much more. So, just how do I get automobile insurance policy? Obtaining an automobile insurance policy estimate from Nationwide has never ever been simpler. See our auto insurance policy quote section as well as enter your zip code to begin the vehicle insurance quote procedure.

Commonly automobile insurer will bill much more for younger chauffeurs and supply affordable prices for older chauffeurs. Insurance policy service providers see young chauffeurs as unskilled as well as have a better threat of obtaining in crash. In Texas, the typical teenager vehicle driver between the age of 16 and 19 will certainly pay $278. 89 monthly while a driver in their 40s will pay an average of $132 (low-cost auto insurance).

80 Rental fee $136 - cheap. 26 Generally, motorists who currently have car insurance protection will obtain a less expensive monthly rate than drivers who do not. Because cars and truck insurance is a demand in all 50 states, companies may question why you don't currently have insurance coverage. Due to this, they might see you as a greater danger motorist.

How Much Is Car Insurance? - The Balance Fundamentals Explained

33 each month. Coverage, Avg month-to-month price Complete Protection $138. 33 Liability Just $87. 14 The statistics listed on this page are from our own in home coverage. We track and also tape quotes that providers have given based upon different requirements. The rates and also averages revealed on this web page ought to just be used as a price quote.

Ordinary Auto Insurance Prices by Coverage Degree When it pertains to shielding your auto, we comprehend that everyone's requirements are different. That's why we provide different sorts of auto insurance policy protection. Having full coverage aids you remain risk-free when driving. This is likewise among the reasons the ordinary price of cars and truck insurance policy ranges consumers.

A plan that will pay for property problems up to $50,000 will certainly have a higher costs than one that only pays for repair services up to $25,000. Typical Automobile Insurance Policy Rates by Age Your auto insurance policy rates will certainly additionally differ based upon your age. automobile insurance coverage business frequently take into consideration young chauffeurs, like teens, to be more of a danger behind the wheel (affordable car insurance).

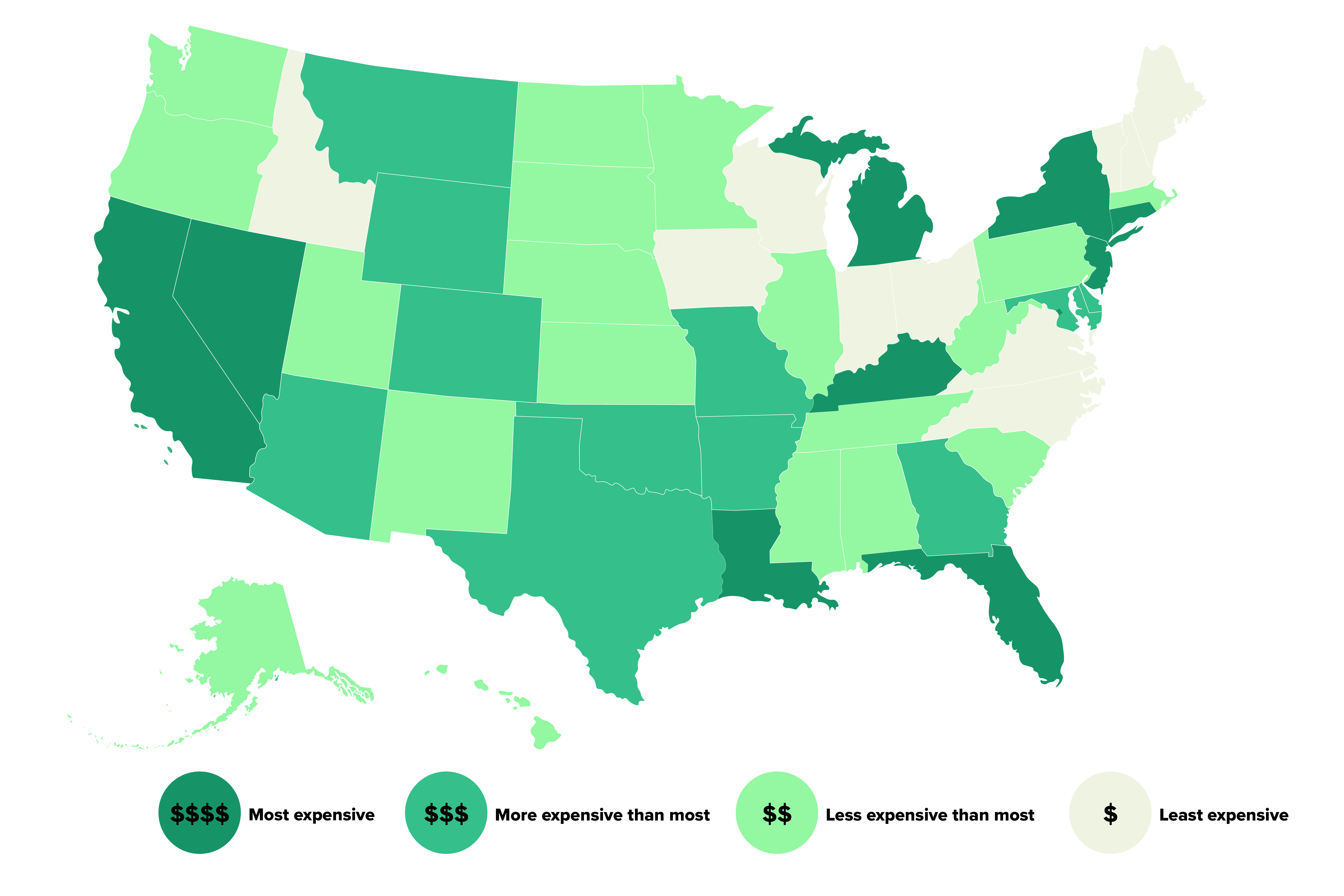

On top of this, car insurance is usually more pricey for guys than ladies. 3 The longer you've been driving and the older you get, the less costly vehicle insurance prices have a tendency to be. Ordinary Auto Insurance Coverage Prices by State The ordinary car insurance policy rate by state varies. According to the Insurance Info Institute (III), Iowa has some of the most affordable car insurance policy in the country at $674, while Louisiana had several of one of the most pricey at $1,443.

At What Age Is Cars And Truck Insurance Coverage Cheapest? 5 That implies as a vehicle driver gets older and obtains more experience on the roadway, their rates will likely reduce.

Which Age Group Pays the A Lot Of for Vehicle Insurance? Insurer typically charge extra for motorists that are under the age of 25. 7 If you are half a century or older, you satisfy the AARP participant age need and can request insurance coverage with The Hartford. Given that 1984, The Hartford has helped almost 40 million AARP participants get the vehicle coverage they need through unique advantages and discount rates What State Has the Most affordable average cars and truck insurance prices? According to III, in 2017, these states had several of the most affordable cars and truck insurance coverage prices:8 For more information, obtain a quote from us today.

The 8-Minute Rule for See The Average Auto Insurance Rate For Your Michigan Zip Code

They'll assist you obtain the auto plans you require, whether it's to aid pay for problems after a mishap or to safeguard you from collisions with without insurance drivers.

Why do average auto insurance coverage rates by age differ so much? 5 percent of the populace in 2017 but stood for 8 percent of the overall price of vehicle crash injuries.

The rate data originates from the AAA Structure for Website Traffic Security, and also it accounts for any kind of accident that was reported to the authorities - cheaper cars. The average costs data comes from the Zebra's State of Vehicle Insurance policy record. The rates are for plans with 50/100/50 obligation protection restrictions as well as a $500 deductible for thorough as well as crash coverage.

According to the National Highway Web Traffic Safety And Security Management, 85-year-old guys are 40 percent most likely to get involved in an accident than 75-year-old men. Looking at the table over, you can see that there is a direct correlation in between the collision price for an age and that age's typical insurance premium.

Maintain in mind, you could find better rates with an additional business that does not have a particular pupil or elderly price cut. Typical Automobile Insurance Coverage Fees And Cheapest Carrier In Each State Since automobile protection prices vary so a lot from state to state, the carrier that supplies the cheapest vehicle insurance policy in one state might not provide the most affordable insurance coverage in your state.

You'll additionally see the typical cost of insurance coverage because state to help you compare. The table additionally consists of prices for Washington, D.C. These price approximates relate to 35-year-old vehicle drivers with good driving documents as well as credit score (laws). As you can see, typical vehicle insurance policy costs vary commonly by state. Idahoans pay the least for cars and truck insurance, while vehicle drivers in Michigan pay out the huge dollars for coverage.

The Facts About Why Is My Car Insurance So High? - Investopedia Uncovered

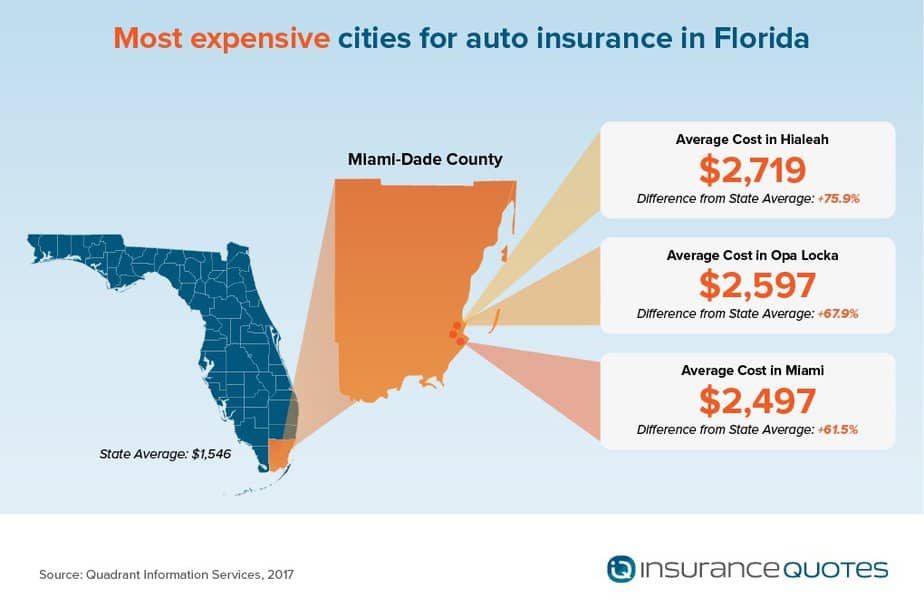

If you live in midtown Des Moines, your costs will most likely be more than the state standard. On the various other hand, if you stay in upstate New york city, your vehicle insurance plan will likely cost much less than the state average. Within states, automobile insurance policy costs can differ commonly city by city.

The state isn't one of the most costly overall. Minimum Coverage Requirements Many states have financial duty regulations that require chauffeurs to bring minimal car insurance policy coverage. You can only bypass coverage in two states Virginia as well as New Hampshire but you are still economically responsible for the damage that you trigger.

No-fault states consist of: What Various other Variables Affect Cars And Truck Insurance Coverage Rates? Your age and your house state aren't the only things that influence your rates. Insurance firms utilize a variety of factors to identify the cost of your premiums. Here are several of one of the most important ones: If you have a clean driving record, you'll discover far better prices than if you have actually had any current crashes or web traffic violations like speeding tickets.

Some insurance firms may supply discounted prices if you do not use your automobile a lot. Others supply usage-based insurance that might conserve you cash. Insurance firms factor the likelihood of a lorry being stolen or damaged as well as the price of that vehicle into your costs. If your auto is one that has a likelihood of being stolen, you might need to pay even more for insurance policy.

liability vans car cheapest

liability vans car cheapest

In others, having negative credit history might cause the expense of your insurance coverage costs to rise substantially. Not every state allows insurance companies to make use of the sex provided on your vehicle driver's license as an identifying consider your costs. In ones that do, female motorists commonly pay a little much less for insurance coverage than male drivers.

Why Do Car Insurance Coverage Rates Modification? Looking at typical cars and truck insurance coverage rates by age and state makes you wonder, what else affects prices?

More About What's The Average Cost Of Car Insurance In 2020? - Business ...

An at-fault mishap can increase your price as much as 50 percent over the following 3 years. Overall, auto insurance has a tendency to get extra costly as time goes on.

There are a number of various other price cuts that you might be able to utilize on right currently. Right here are a few of them: Lots of companies offer you the greatest discount for having a great driving history. Also called bundling, you can get lower prices for holding even more than one insurance coverage with the very same company.

House owner: If you have a residence, you could obtain a house owner price cut from a number of carriers. Obtain a discount rate for sticking with the very same firm for numerous years. Here's a secret: You can constantly contrast rates each term to see if you're getting the very best rate, also with your commitment discount - auto insurance.

However, some can also raise your prices if it transforms out you're not a great chauffeur. Some business give you a discount rate for having a good credit rating score. When browsing for a quote, it's a good idea to call the insurance company and ask if there are anymore price cuts that put on you.

One of the largest aspects for consumers looking to acquire auto insurance is the price. Not just do costs differ from business to company, but insurance policy expenses from state to state vary.

credit cheap car vehicle insurers

credit cheap car vehicle insurers

Average rates differ extensively from state to state. Counting on typical automobile insurance costs to approximate your car insurance costs may not be the most exact way to figure out what you'll pay.

3 Simple Techniques For Ten Ways Motorists Can Save On Auto Insurance Premiums

Insurance companies utilize several factors to identify rates, and you may pay more or less than the typical chauffeur for protection based on your threat account. For instance, younger motorists are usually more most likely to obtain into a crash, so their premiums are normally more than standard. You'll additionally pay more if you have an at-fault crash, multiple speeding tickets, or a DUI on your driving record.

auto insurance cheap auto insurance affordable vans

auto insurance cheap auto insurance affordable vans

It might not offer sufficient security if you're in a mishap or your automobile is damaged by one more covered occurrence. cheaper auto insurance. Curious about just how the ordinary rate for minimum protection piles up against the cost of complete protection?

One of the aspects insurers make use of to identify rates is location. And since insurance coverage laws as well as minimal coverage needs differ from state to state, states with higher minimum demands commonly have greater average insurance coverage costs (cheap insurance).

A lot of but not all states permit insurance provider to make Have a peek at this website use of credit report when setting rates. Generally, applicants with lower scores are more probable to file a claim, so they normally pay extra for insurance coverage than drivers with greater credit rating. If your driving document consists of accidents, speeding up tickets, DUIs, or various other violations, expect to pay a higher costs - cheap.

Automobiles with higher price generally set you back more to guarantee. Drivers under the age of 25 pay greater prices because of their lack of experience as well as raised crash risk. Guy under the age of 25 are typically estimated greater prices than ladies of the exact same age. The space shrinks as they age, and ladies might pay slightly more as they obtain older.

Because insurance firms have a tendency to pay more claims in risky areas, prices are generally greater. Celebrating a marriage generally leads to lower insurance policy costs. Getting appropriate insurance coverage might not be cheap, yet there are methods to obtain a discount on your cars and truck insurance policy. Right here are 5 common discounts you may certify for.

The 3-Minute Rule for How Much Is Car Insurance? - Liberty Mutual

If you possess your residence as opposed to leasing it, some insurance providers will give you a price cut on your auto insurance coverage premium, even if your residence is guaranteed with an additional firm (auto insurance). Aside From New Hampshire as well as Virginia, every state in the country calls for vehicle drivers to preserve a minimum amount of liability insurance coverage to drive legitimately.

cheaper car insurance low-cost auto insurance insurers insurance

cheaper car insurance low-cost auto insurance insurers insurance

https://www.youtube.com/embed/CBx1L_th8WE

It may be tempting to stick with the minimum limitations your state needs to save money on your premium, but you might be placing on your own at danger. State minimums are notoriously low and also could leave you without adequate defense if you're in a major crash. cheap car. Many experts advise maintaining sufficient coverage to safeguard your properties.

Unknown Facts About Full Coverage Auto Insurance: What Is It? - The Balance

Medical or No-Fault Insurance coverage We provide it in all states where we work, yet it varies. See your agent for details. Without insurance as well as Underinsured Not every person is as accountable as you. This insurance coverage safeguards you and also your travelers if physical injury is brought on by a vehicle driver without ample cars and truck insurance coverage.

With our replacement expense insurance coverage, your automobile can be approximately 4 model years old (five in select states) and also still be eligible for substitute expense coverage (credit score). Since remaining in a crash should not mean you need to give up on having a brand-new automobile. Driveology Your excellent driving can help you make discount rates on your automobile insurance coverage rates.

Young Motorist Security Program The flexibility of a driver's license also brings duty. Our Young Motorist Safety Program is created to aid young vehicle drivers stay secure on the road.

In a lot of cases, there are no out-of-pocket expenses as well as we make it simple to return when driving. One phone call to our Claims Center starts the process to obtain you back when traveling: 1-800-226-6383. insurance. Phenomenal Claims Solution If you're ever before included in a mishap, you do not require to fret about going back as well as forth with your insurance provider over your case.

Unknown Facts About Average Car Insurance Costs In March 2022 - Policygenius

perks cheap cars insurance affordable

perks cheap cars insurance affordable

With an insurance claims contentment rate over 90 percent, we verify time and also once again that we have what it requires to smooth the bumps you'll experience on life's roadways. Ways to Save The best insurance coverage requires to be budget-friendly. We provide discount rates to help you save, and to maintain protection budget friendly.

A car insurance coverage can consist of numerous different type of coverage. Your independent insurance policy agent will give expert suggestions on the type and amount of automobile insurance policy coverage you should need to fulfill your private requirements as well as conform with the regulations of your state (cheapest car insurance). Below are the primary type of coverage that your plan might consist of: The minimal protection for bodily injury differs by state as well as may be as reduced as $10,000 per person or $20,000 per accident.

If you harm a person with your vehicle, you can be demanded a great deal of money. The quantity of Responsibility coverage you carry should be high sufficient to safeguard your possessions in case of a mishap - cheapest. Many experts suggest a limitation of at the very least $100,000/$300,000, however that might not be sufficient.

If you check here have a million-dollar house, you could lose it in a legal action if your insurance protection wants (car). You can obtain added coverage with a Personal Umbrella or Individual Excess Responsibility policy. The greater the value of your assets, the extra you stand to lose, so you need to get responsibility insurance proper to the worth of your assets.

Our Travelers Insurance: Business And Personal Insurance ... Statements

You do not need to identify just how much to buy that relies on the vehicle(s) you insure. But you do require to make a decision whether to purchase it as well as how huge a deductible to take. The higher the deductible, the reduced your costs will certainly be - cheapest auto insurance. Deductibles usually range from $250 to $1,000.

If the vehicle is just worth $1,000 as well as the insurance deductible is $500, it may not make sense to purchase crash protection. As with Accident protection, you require to select an insurance deductible - credit.

cheaper cars cheapest auto insurance cheapest auto insurance cheapest car insurance

cheaper cars cheapest auto insurance cheapest auto insurance cheapest car insurance

Comprehensive protection is usually offered along with Collision, and both are often described together as Physical Damages insurance coverage - vans. If the vehicle is rented or financed, the leasing business or loan provider might need you to have Physical Damages coverage, despite the fact that the state regulation may not need it. Covers the expense of healthcare for you as well as your travelers in the event of an accident.

For that reason, if you select a $2,000 Medical Expenditure Limit, each guest will have up to $2,000 coverage for medical insurance claims arising from a mishap in your automobile. If you are associated with a mishap as well as the various other driver is at fault however has insufficient or no insurance, this covers the void between your expenses as well as the various other vehicle driver's insurance coverage, approximately the limitations of your insurance coverage.

Excitement About How To Get A Salvage Title Cleared? : Faq Answered » - Way

The restrictions required and also optional limitations that might be offered are established by state regulation. cheaper car insurance. This protection, needed by law in some states, covers your medical costs as well as those of your guests, no matter who was in charge of the accident. The limitations needed as well as optional limits that may be offered are established by state law.

How much automobile insurance policy do you need? The solution depends on a variety of variables, consisting of where you live, how much your auto is worth, as well as what various other properties you need to shield. Below's what you need to understand - low cost. Trick Takeaways A lot of states need you to contend least a minimum quantity of insurance coverage for any injuries or residential or commercial property damage you cause in a crash.

accident credit cheapest car affordable

accident credit cheapest car affordable

Comprehensive coverage, also optional, protects versus various other threats, such as theft or fire. Without insurance motorist protection, necessary in some states, protects you if you're hit by a chauffeur who does not have insurance coverage. Exactly How Auto Insurance Works A vehicle insurance plan is in fact a bundle of several different kinds of insurance coverage. automobile.

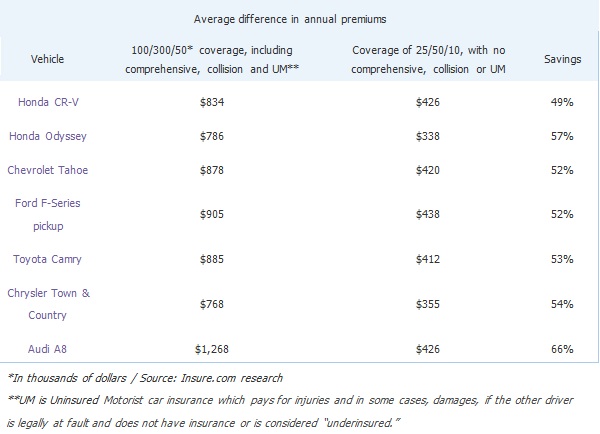

If you have your house or have a considerable amount of cash in savings, a pricey crash might place them at risk. In that case, you'll wish to purchase more protection. The not-for-profit Consumers' Checkbook, to name a few, suggests purchasing coverage of at least 100/300/50, just in instance. The distinction in cost in between that protection as well as your state's minimum will probably not be quite.

All about Welcome To Bristol West Insurance Group

It's represented on your policy as the 3rd number in that sequence, so a 25/50/20 plan would provide $20,000 in protection. Some states require you to have just $10,000 and even $5,000 in home damages liability insurance coverage, however $20,000 or $25,000 minimums are most common. Once more, you might wish to get more protection than your state's minimum.

A generally suggested level of home damage insurance coverage is $50,000 or even more if you have considerable possessions to safeguard. Clinical Settlements (Med, Pay) or Injury Protection (PIP) Unlike physical injury liability coverage, clinical payments (Medication, Pay) or injury security (PIP) covers the expense of injuries to the chauffeur and any type of passengers in your auto. cheap auto insurance.

Whether medical settlements or PIP coverage is mandatory, optional, or even available will certainly depend on your state. In states with no-fault insurance laws, such as Florida and also New York City, PIP coverage is obligatory. In Florida, for instance, chauffeurs need to carry at the very least $10,000. In New York, the minimum is $50,000.

If you don't have medical insurance, nonetheless, you might want to buy much more. That's specifically true in a state like Florida, where $10,000 in coverage might be insufficient if you remain in a major mishap. Accident Protection Collision coverage will certainly pay to repair or change your auto if you're associated with an accident with an additional car or hit some various other item.

The smart Trick of How Much Is Car Insurance In California: Average Cost (2022) That Nobody is Discussing

accident insurers automobile dui

accident insurers automobile dui

If you have a car lending or are renting the car, your lending institution might need it. When you have actually settled your finance or returned your leased cars and truck, you can go down the coverage. Even if it's not called for, you may wish to get accident protection. For example, if you would certainly have difficulty paying a big repair work expense out of pocket after a mishap, crash coverage might be great to have.

cheapest car insurance affordable dui insure

cheapest car insurance affordable dui insure

The cost of collision insurance coverage is based upon the value of your automobile, as well as it usually includes a deductible of $250 to $1,000. So if your cars and truck would certainly set you back $20,000 to change, you would certainly pay the initial $250 to $1,000, relying on the deductible you picked when you got your policy, and the insurance firm would certainly be liable for as high as $19,000 to $19,750 after that.

In between the cost of your yearly costs as well as the insurance deductible you 'd have to pay out of pocket after an accident, you could be paying a lot for very little coverage (cars). Also insurer will certainly inform you that going down collision coverage makes feeling when your auto is worth much less than a few thousand dollars.

As with extensive insurance coverage, states do not require you to have accident coverage, yet if you have an auto lending or lease, your loan provider might need it. And also again, when you've paid off your financing or returned your rented vehicle, you can go down the protection.

What Is Full Coverage? What Does It Cover? - Mapfre ... - An Overview

You'll additionally wish to take into consideration just how much your car deserves compared to the expense of covering it year after year. Uninsured/Underinsured Driver Protection Even if state legislations need drivers to have liability insurance coverage, that doesn't indicate every chauffeur does. Since 2019, an approximated 12. 6% of driversor regarding one in eightwere without insurance.

That is where this sort of protection is available in. It can cover you and also relative if you're wounded or your vehicle is damaged by an uninsured, underinsured, or hit-and-run motorist. Some states need drivers to carry uninsured vehicle driver coverage (). Some additionally call for underinsured vehicle driver coverage (UIM). Maryland, for instance, requires vehicle drivers to lug uninsured/underinsured motorist bodily injury responsibility insurance coverage of at the very least $30,000 each and also $60,000 per accident.

If your state needs uninsured/underinsured motorist insurance coverage, you can purchase greater than the called for amount if you desire to. You can likewise purchase this coverage in some states that do not need it. If you aren't required to get uninsured/underinsured driver protection, you may intend to consider it if the protection you currently have would certainly want to pay the costs if you're associated with a major mishap.

Various Other Kinds of Coverage When you're shopping for automobile insurance, you might see a few other, absolutely optional types of coverage. Those can include:, such as towing, if you have to rent a vehicle while your own is being repaired, which covers any type of distinction between your vehicle's cash value and also what you still owe on a lease or loan if your cars and truck is a total loss Whether you need any one of those will depend on what other resources you have (such as subscription in a car club) and also just how much you might pay for to pay out of pocket if you must. cheap.

The Ultimate Guide To Welcome To Bristol West Insurance Group

Whether to purchase greater than the minimum needed insurance coverage and also which optional sorts of protection to consider will certainly depend on the properties you require to safeguard as well as exactly how much you can manage to pay. Your state's automobile division internet site ought to describe its demands and also may provide various other advice particular to your state. prices.

Full insurance coverage implies the vehicle driver desires more than simply responsibility protection. Full coverage consists of not just comprehensive and also accident insurance, yet uninsured or underinsured motorist insurance coverage.

There are as well numerous without insurance or underinsured drivers when driving, as well as obtaining into a crash with one can truly hurt you financially without this kind of insurance coverage. How much protection you'll need depends upon your individual situation - insured car. If you have properties, such as a home or financial investments, you desire to make certain you have enough insurance coverage in case of a severe collision.

If you do not have much in the way of assets, you won't require as much insurance coverage, but you need to lug the minimum amount of insurance needed to lawfully operate a vehicle in your state.

Our How Much Does Car Insurance Cost? Ideas

https://www.youtube.com/embed/g-2kH-Ru09EHow Much is Full Coverage Cars And Truck Insurance in California? In order to get the finest automobile insurance coverage in The golden state, also known as low-cost vehicle insurance policy that likewise keeps you well secured on the roadway, we advise complete insurance coverage cars and truck insurance coverage, which has an ordinary The golden state auto insurance coverage price of $142 each month or $1,700 each year. car insured.

More About Boat And Personal Watercraft Insurance - Foremost

Edit your About page from the Pages tab by clicking the edit button.

Boat Insurance - Missouri & Surrounding States - David Pope - The Facts

Edit your About page from the Pages tab by clicking the edit button.

The Greatest Guide To Insurance For Your Boat - Mass.gov

Edit your About page from the Pages tab by clicking the edit button.

Some Known Details About What Does Boat Insurance Cover? A Newbie Guide

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on Liability-only Boat Insurance Coverage - Skisafe

Edit your About page from the Pages tab by clicking the edit button.

The 4-Minute Rule for Boat Insurance In Wa - Pnw Insurance Group - (253) 527-6261

Edit your About page from the Pages tab by clicking the edit button.

Little Known Facts About Insuring Classic Cars - I Drive Safely.

Edit your About page from the Pages tab by clicking the edit button.

Top Guidelines Of Antique Or Collector Car Insurance

Edit your About page from the Pages tab by clicking the edit button.

The Of Classic And Collector Car Insurance Quotes - Njm

Edit your About page from the Pages tab by clicking the edit button.

Not known Facts About Classic Car Insurance In Massachusetts

Edit your About page from the Pages tab by clicking the edit button.

All About Guide To Classic Car Insurance – Forbes Advisor

Edit your About page from the Pages tab by clicking the edit button.

The 25-Second Trick For Classic Car Insurance In Florida - Getjerry.com

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on How To Negotiate A Total Loss Vehicle Value - Sapling

Edit your About page from the Pages tab by clicking the edit button.

Things about How To Negotiate With Home Insurance Adjuster - Dick Law Firm

Edit your About page from the Pages tab by clicking the edit button.

An Unbiased View of How To Negotiate With Car Insurance Adjusters About Car ...

Edit your About page from the Pages tab by clicking the edit button.

Not known Factual Statements About Negotiating With Insurance Companies - James Publishing

Edit your About page from the Pages tab by clicking the edit button.

The Facts About What Do Auto Insurance Claims Adjusters Do? Uncovered

Edit your About page from the Pages tab by clicking the edit button.

How Counter-offer Letter To Insurance Company For Your Accident ... can Save You Time, Stress, and M

Edit your About page from the Pages tab by clicking the edit button.

Get This Report on Comparing Credit Cards With Rental Car Coverage

Countries occasionally excluded from charge card car insurance coverage consist of andamong a few others. This is one more suggestion that it is necessary to speak about exemptions with your bank card companies prior to relying on this protection. A WORD OF WARNING TO THE UNINSURED If you don't have individual vehicle insurance, it is essential to do your homework before signing the rental car business's insurance coverage waiver or depending on your charge card's auto leasing insurance policy advantage (low cost).

Several days or weeks prior to your leasing, call your charge card customer care line as well as see to it you understand the answers to the complying with concerns: Is this main or secondary insurance coverage? The solution to this concern might depend upon where your leasing is taking place, so make sure you're clear with the client service representative concerning your details scenario so they can provide accurate details - cheap car insurance.

cheapest laws cheaper car prices

What automobiles aren't covered? If you're intending to lease a deluxe or specialized vehicle even a van or truck might be taken into consideration a specialized leasing it might not be covered. Furthermore, some popular car makes such as BMW or Mercedes-Benz could be considered luxury cars as well as be exempt from protection (auto).

International leasings as well as those eligible for key insurance usually take pleasure in much longer qualification periods. What isn't covered? Do you have protection for the rental company's loss-of-use cost? What regarding lugging in case of a collision? In virtually all situations, charge card protection is restricted to an accident damages waiver circumstance, meaning there isn't coverage for accident, obligation or home damages.

Some Of How To Get Extra Rental Car Insurance From Your Credit Card

WHAT CREDIT REPORT CARDS DEAL PRIMARY AUTO RENTAL INSURANCE? Chase bank card Chase cards have, recently, end up being the front-runners when it involves main vehicle leasing insurance via your bank card, with the majority of company cards and also travel incentives cards using main protection. As a matter of fact, also a few cards marketed as "cash-back cards" (such as Chase Freedom Unlimited) supply primary insurance coverage for autos leased abroad it's secondary protection for services in the USA.

This is just a tasting of cards that provide car leasing insurance coverage amongst the benefits. Just like any type of charge card advantage, make certain you call your issuer as well as request full details in order to totally benefit from this potentially money-saving perk. Please note: The info in this write-up is believed to be exact since the date it was written.

business insurance perks cars car insurance

See the online credit report card application for full terms as well as conditions on deals and benefits. Please validate all terms and also problems of any credit card prior to applying.

credit cheaper cheaper car insurance cheaper

credit cheaper cheaper car insurance cheaper

Card, Scores. insured car. com does not examine every firm or every offer available on the marketplace.

Not known Facts About Rental Car Insurance: Does My Insurance Cover It?

Select the Card listed below to review the complete Policy for Automobile Rental Loss & Damage Insurance policy related to that Card. If your Card is not noted on this web page or if you are an Extra Card Member, please call the number on the back of your Card to validate your advantages.

The deals for monetary products you see on our platform come from business that pay us. The money we make aids us provide you access to cost-free credit score ratings and also records as well as helps us produce our various other terrific tools and also educational products.

These offers are no longer offered on our website: Chase Sapphire Book, Chase Sapphire Preferred Card, Ink Business Preferred Credit Rating Card Need to save cash on your next trip? Take into consideration decreasing the rental car firm's crash damage waiver (CDW) or loss damage waiver (LDW) to stay clear of the everyday fee.

Lots of credit scores cards especially travel bank card or incentives credit scores cards include rental vehicle security as a cost-free benefit to cardholders. Nonetheless, the insurance coverage, limitations and also policies can differ depending on your card. Comprehending what's covered and also just how the advantage works can help you make an educated decision the following time you step up to a rental auto firm counter.

All about Do You Need Rental Car Insurance?

A lot of states in the U.S. require you to have at the very least some responsibility insurance coverage if you want to drive an automobile. Obligation coverage helps pay for others' medical bills and also damages to others' vehicles as well as building.

The names as well as protection rules or limitations might vary depending on the rental business, however in general, they drop into these 3 classifications. In some situations, the coverage uses to thefts outside the rental automobile, and it may consist of the personal building of others taking a trip with you.

The CDW or LDW typically covers theft and also damage to the rental car provided the loss or damage was not the result of any banned use of the car comparable to an individual plan's collision and comprehensive protection (cheaper car). The waiver likewise covers the rental company's loss-of-use costs. Your existing insurance policy could currently cover you in a number of these scenarios.

Charge card' rental automobile defense might only encompass the CDW or LDW section of insurance coverage. The benefit assists repay you for damages to or burglary of the rental automobile. car insured. In some instances, a charge card's coverage will certainly also pay for loss-of-use, management or towing costs incurred by the rental vehicle agency.

Everything about Best Credit Cards With Car Rental Insurance In 2022

When You can find out more you're traveling for organization, the Ink Service Preferred Credit score Card gives primary coverage for rental vehicles. And if your service journey turns right into a personal getaway, the Ink Organization Preferred Credit Card still uses second protection for rental cars.

Check out all the factors why the may be a great choice for your next company journey - insurance affordable. Here are a few practices to help you use credit report card rental car insurance policy to its maximum. If you divided the payment with another card, you may not be covered. Your bank card might require you to decline the car rental business's collision-damage waiver for your card's insurance policy protection to begin.

Your charge card may cover damages to the rental auto. If you obtain right into a cars and truck accident, the debt card provider won't always pay for damage you cause to other lorries involved in a crash or injuries sustained by individuals in those vehicles - cheaper. Check your card's terms to determine what other protection you could require.

insurance insurance companies risks cheap insurance

insurance insurance companies risks cheap insurance

affordable cheapest car cheaper car insurance perks

affordable cheapest car cheaper car insurance perks

Want traveling incentives? Louis De, Nicola is an individual financing author and has actually created for American Express, Discover as well as Nova Debt.

The 6 Best Credit Cards For Rental Car Insurance - Financebuzz Can Be Fun For Anyone

Image this, you will authorize the dotted line for the "collision damages waiver" or CDW insurance coverage when you bear in mind that your credit rating card uses you insurance coverage for rental automobiles. insurance affordable. Many incentives bank card supply some degree of security when you utilize it to pay for a rental auto, however the security frequently differs from one card to an additional.

What kind of coverage do rental auto firms offer? Commonly, rental automobile companies supply 4 sorts of automobile insurance that they offer to you prior to you lease a lorry. car. They include the following:: This boosts your liability approximately $1 million. Can set you back anywhere between $7-$15 per day.: Forgoes your concern for burglary or problems.

: This insurance coverage supplies clinical and unintentional fatality advantages need to you or your passengers become damaged or killed as a result of a crash. Protection can set you back $1-$7 per day.: Obtain settlement for any kind of personal effects that is swiped from your rental lorry. Can set you back anywhere between $1-$5 daily.

It's constantly a great concept to comb up on your vehicle insurance plan (as well as home) to see what's covered and what's not, so you recognize where your spaces in insurance coverage are. If you're uncertain of what remains in your vehicle policy, contact one of our agents at TGS insurance coverage! Our team will certainly enjoy to assist you better understand your plan, deal solutions to any type of voids, and best of all, save you a heap of cash! It is essential to note that relying on what sorts of defense you ought to opt-out of depends completely on the worth of your rental car and also what your very own automobile insurance coverage restrictions, deductibles, and insurance coverages. insurance affordable.

Rumored Buzz on Why Credit Card Insurance May Not Pay For A Rental Car Crash

When you go to get your rental cars and truck, you'll need to choose whether you intend to pay for the rental company's collision damages waiver (CDW). The waiver takes the duty off your hands if any type of damages may sustain while in your ownership. If your charge card provides cost-free CDW security as a part of its incentives, you can save some money and prevent having to pay for the protection you currently have. car insurance.

Resources one is your 2nd source of insurance coverage when you're in your house nation and functions as your key insurance when exterior of the nation (except for the countries that are unqualified). You are guaranteed 15 days of defense for rental cars and trucks in your nation and also 31 days outside the country.

https://www.youtube.com/embed/NhLTyL_ZM2Q

Visa cards cover 31 rental days in a row and also Mastercards cover 15 rental days straight. For Visa cards, it shields from burglary and damages as much as the cash value of many autos. For Mastercards, it covers theft and also damages as much as $50,000 or less. Shields from loss-of-use and also towing expenditures.

Little Known Facts About What Is A Totaled Car? - Lemonade.

!? How can I obtain a quote for my amounted to cars and truck quickly? What is The Value of An Amounted To Car? There's no specific formula you can utilize to establish your completed automobile value.

cheaper car insurance company vehicle insurance insured car

cheaper car insurance company vehicle insurance insured car

And also even then, it's typically up for discussion at least a little. You can, nevertheless, get insight into just how that number is achieved. That's the resale price for your lorry if it had not been totaled. The insurer will consider current listings and also sales for comparable vehicles in your location.

The car is worth more than the staying balance on your vehicle financing. If you have actually just acquired your within the past pair of years, your funding equilibrium is higher than the amount your car has originally depreciated (insured car).

In states with a total-loss limit below 80%, it would be taken into consideration completed. Vital Actual money worth is an additional way of claiming what the lorry is worth at the time of loss (cars).

Some points that insurance provider utilize to determine the actual worth and the total loss value of your vehicle are its year, make, design, mileage, physical wear as well as tear, as well as damages created in the mishap. If your lorry is fairly new and in excellent problem, it will certainly have a greater real value than a cars and truck that is old as well as worn (insurers).

If you still owe cash on your automobile, this payoff, all or partially, goes straight to your lender as opposed to to you. Why Your Total-Loss Benefit Is Less Than Your Loan Many individuals have encountered the frustrating circumstance of obtaining a payoff check, only to realize it's not adequate to cover their car finance's remaining equilibrium. cheap.

Some Known Factual Statements About My Car Is Totaled- Will Insurance Pay? - Thompson Law Firm

Right here are some reasons your vehicle's payback might be much less than your financing balance. Vehicles Depreciate in Value The second you drive your brand-new auto off the whole lot, its worth starts to decrease, and also it remains to do so over its life expectancy - low cost. In fact, cars and trucks decrease a standard of 20% throughout their first year and a further 40% in the next four years.

If you don't have gap insurance, you are in charge of the distinction between your insurance coverage payout and also your vehicle financing equilibrium. You Rolled Over a Previous Auto Loan Into Your Existing One If you surrendered a previous auto loan, that negative equity is included to your lending. This implies your funding is for even more than the existing vehicle's worth, and also your total-loss benefit most likely won't cover the balance - insurance affordable.

You must verify that your automobile is worth even more than the insurance provider states it is. Maintain Car Lendings Different If possible, don't roll the remaining equilibrium of your finance into a new finance for your following cars and truck. If you do, you'll owe more on the brand-new vehicle than it deserves.

Regularly Asked Concerns (Frequently asked questions) What occurs to your cars and truck when it's thought about totaled? If your auto is totaled, you need to move the title to your insurance policy business prior to it will send https://storage.googleapis.com your payout - credit.

Call your representative for the exact action in this procedure. auto.

credit score cheaper cars cheaper auto insurance cheaper

credit score cheaper cars cheaper auto insurance cheaper

What Is Overall Loss Vehicle Insurance Policy? If you enter into a mishap and also the price to repair your lorry is greater than its real cash money value (ACV), your cars and truck insurance policy firm will certainly consider it an overall loss. It's likewise a failure if it can not be repaired at all. Failure automobile insurance implies you have the appropriate coverages to assist you pay for a brand-new vehicle if your own gets totaled.

The Ultimate Guide To You May Be Surprised How Much Insurance Pays When A Car ...

Some use a total loss limit, which can differ in between 50% and also 100%. In Arkansas, the total loss threshold is 70%. This indicates your vehicle is stated a failure if the damages are better than 70% of its worth. So, if your auto is worth $6,000 as well as suffers greater than $4,200 in damages, your insurer will certainly consider it an overall loss.

Explain any kind of mistakes they might have about your car. Be prepared to give supporting documents. You and the insurer each employ your own appraiser and split the costs of a third evaluator, who functions as "umpire" by choosing which appraisal is precise. The result of the evaluation process is binding, but if you're not pleased, you can file an issue with your state's insurance policy commissioner. insurance affordable.

com LLC has actually made every effort to make certain that the details on this website is appropriate, however we can not guarantee that it is without mistakes, mistakes, or omissions. All web content as well as solutions given on or through this site are offered "as is" and also "as available" for use. Quote, Wizard.

You expressly agree that your use this website goes to your single danger.

Table of Component: When Is a Cars And Truck Considered Totaled? An automobile is considered to be a failure when the general expense of problems strategies or surpasses the value of the cars and truck. A lot of insurance business figure out an auto to be completed when the vehicle's price for fixings plus its salvage worth corresponds to even more than the real cash money value of the automobile.

Just how does your insurance identify if your vehicle is a failure? Evaluators will estimate the price of fixings, then determine if the cost to repair the car consisting of things like cost of substitute parts, salvage worth and also labor costs will certainly equate to greater than what the auto is really worth on the competitive market (accident).

All About How Is Total Loss Value Calculated? - The Balance

insurance company cheaper cars credit insurance companies

insurance company cheaper cars credit insurance companies

To better recognize what comprises a complete loss, allow's take a better look right into how a complete loss's worth is calculated as well as then we'll get to the base of exactly how much insurance coverage pays for an amounted to car. If the Airbags Deployed, Is the Auto Considered a Total Loss? Not always. vehicle.

If, nonetheless, the expense of changing the air bags is more than the worth of your auto, your lorry will likely be a failure. Many wonder if airbags deploy, is a cars and truck totaled even if the damage is minor? A great deal much more goes into corresponding a complete loss than just airbag release - cheap car.

If, after including the salvage value expense to the complete repair work price quote, that figure is greater that the automobile's actual money value, the car is considered amounted to for the most part. What Happens When Your Car Is Completed and You Are Not At-fault? In scenarios where an accident results in an overall loss at the mistake of another motorist, the at-fault driver's insurance coverage will usually pay you the worth of your amounted to automobile.

You'll usually have to pay all of your insurance deductible regardless of how much insurance coverage pays for an amounted to cars and truck - car insured. Do you pay a deductible if your vehicle is totaled and also you still owe thousands on the lorry?

If you were in a mishap that incurred $5,000 in damages, your insurance policy business would withhold the insurance deductible of $1,000 as well as pay the continuing to be $4,000. At American Family Members Insurance coverage, we recognize blunders occur, and want to aid you out when we can.

Make certain to connect to your representative and also ask about adding this essential coverage. What Occurs When Your Auto Gets Totaled? Typically, the insurance firm will certainly take possession of your vehicle with a totaled automobile title transfer to their name. risks. Afterwards, they'll likely market it to a salvage customer.

Indicators on Should You Buy Back Your Totaled Car? - Autotrader You Should Know

This is called being bottom-side-up, and also it's why you must have auto lease or financing gap coverage. Space protection is an added auto insurance coverage you can contribute to your vehicle plan so, in the event you're upside-down when your auto is amounted to, it'll assist pay for the space in between what your cars and truck is worth and also what you still owe to your lender, subject to any type of relevant insurance coverage restrictions.

If your car's ACV is $4,000, you'll have an added $1,000 in gap protection with this added security in location. One more essential information concerning this protection is that the lending should be a car car loan and be obtained only to purchase the lorry. So, if you used a home equity lending to buy a lorry, this protection would certainly not be readily available.

Remain Protected with Automobile Insurance policy Having actually a totaled car isn't an enjoyable circumstance to handle, but understanding what comes next can assist minimize a few of the stress. To much better secure your savings, make certain to explore added insurance coverages that really can make a big distinction: Lease/loan void insurance coverage Called for on the majority of financed or rented vehicles, this included protection aids spend for the difference between what's owed on the auto as well as its actual value, in case of a failure Rental car reimbursement insurance coverage Can repay rental auto expenses when your lorry is undrivable because of a covered loss Connect with your American Family Insurance representative to discover out simply the appropriate automobile insurance coverage protections to protect you from the unexpected.

Restore titles are most appropriate for individuals wanting to rebuild and utilize their cars and truck. A certificate of devastation can be released if an individual wants to sell the automobile for components. vehicle insurance. As soon as a salvage title is released, the proprietor will obtain the real cash worth of the auto minus the salvage worth for the lorry from their insurance policy company.

If you have actually been harmed in an auto mishap, what to do concerning your auto is even further from your mind as you concentrate on healing. The injury legal representatives at The Lawrence Legislation Group offer experienced and also well-informed depiction to car crash victims throughout Duval, Clay, Nassau, Flagler, Putnam, St.

If you have actually been wounded in a car accident, and you wish to know more about your lawful choices, you can contact us online or at (904) 632-0077 (cheapest auto insurance).

The Ultimate Guide To What Happens When You Total A Car In Las Vegas? - Ladah ...

The cash we make assists us give you accessibility to cost-free credit rating and reports and also aids us create our other excellent tools and also academic materials. Compensation might factor into how and where items show up on our platform (and also in what order). Since we generally make cash when you discover an offer you like and get, we attempt to reveal you provides we believe are a good match for you.