8 Easy Facts About What Is The Average Cost Of Auto Insurance? - Moneygeek Shown

insurers dui affordable auto insurance cheapest car

insurers dui affordable auto insurance cheapest car

Other Factors, While not as prominent in the decision, there are several other variables that an insurance company might think about when identifying your rate, consisting of: Line of work, Real estate scenario, Previous insurance protection (particularly, whether there's been had a space in coverage)Driving experience, Discount qualification. low cost auto.

The ordinary car insurance expense for complete protection in the United States is $1,150 per year, or about $97 monthly (cars). No insurance plan can cover you and your car in every scenario. A 'complete protection vehicle insurance policy' plan covers you in most of them. Full insurance coverage insurance policy is shorthand for auto insurance coverage That cover not just your liability yet damages to your vehicle.

A typical complete protection insurance policy will certainly not cover you and your auto in every circumstance. There is no such thing as a "complete protection" insurance plan; it is merely a term that refers to a collection of insurance protections that not just includes obligation coverage yet crash and also extensive.

What is taken into consideration complete insurance coverage insurance policy to one driver may not be the very same as even an additional chauffeur in the exact same family. Ideally, full insurance coverage means you have insurance policy in the kinds and also quantities that are ideal for your revenue, possessions as well as take the chance of account. The factor of all kinds of cars and truck insurance coverage is to maintain you from being monetarily wrecked by an accident or incident (car).

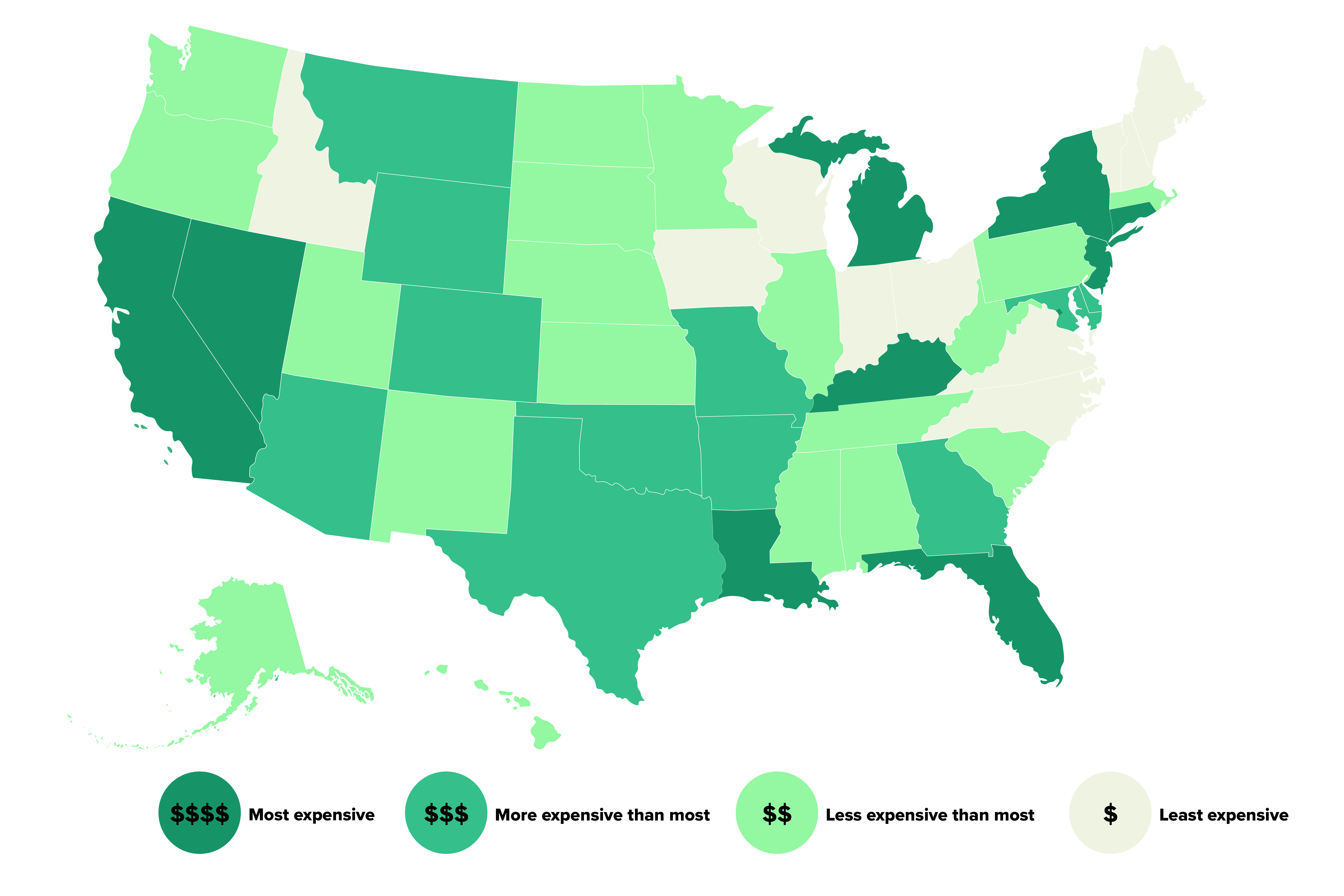

Fees additionally differ by hundreds or even countless dollars from firm to company. That's why we always recommend, as your very first step to conserving cash, that you contrast quotes. Here's a state-by-state comparison of the average annual expense of the following protection degrees: State-mandated minimal responsibility, or, simplistic protection needed to lawfully drive a car, Complete insurance coverage responsibility of $100,000 per person harmed in a mishap you create, as much as $300,000 per accident, and also $100,000 for home damage you cause (100/300/100), with a $500 deductible for extensive as well as collision, You'll see just how much full insurance coverage automobile insurance expenses per month, as well as annually (credit).

The Buzz on New Jersey Drivers See Among Biggest Car Insurance ...

The average yearly rate for complete coverage with greater responsibility limits of 100/300/100 is around $1,150 more than a bare minimum plan. If you pick lower liability restrictions, such as 50/100/50, you can conserve however still have suitable security (cheapest car insurance). The typical regular monthly expense to boost insurance coverage from state minimum to complete insurance coverage (with 100/300/100 limitations) is concerning $97, however in some states it's a lot less, in others you'll pay more.

low-cost auto insurance dui vehicle car

low-cost auto insurance dui vehicle car

Your car, approximately its reasonable market worth, minus your insurance deductible, if you are at mistake or the other chauffeur does not have insurance policy or if it is ruined by an all-natural catastrophe or taken (comp and also accident)Your injuries and of your passengers, if you are hit by a without insurance vehicle driver, as much as the limitations of your uninsured motorist plan (uninsured driver or UM).

Full coverage cars and truck insurance policy policies have exemptions to particular events. Each complete cover insurance coverage will have a listing of exclusions, meaning products it will not cover. Racing or various other rate contests, Off-road usage, Usage in a car-sharing program, Disasters such as war or nuclear contamination, Destruction or confiscation by federal government or civil authorities, Utilizing your automobile for livery or distribution objectives; organization usage, Deliberate damages, Cold, Deterioration, Mechanical failure (typically an optional protection)Tire damages, Things taken from the car (those may be covered by your home owners or renters plan, if you have one)A rental automobile while your own is being repaired (an optional protection)Electronics that aren't permanently attached, Custom components as well as devices (some little amount may be defined in the plan, however you can generally add a motorcyclist for greater quantities)Do I require complete insurance coverage vehicle insurance coverage? You're called for to have responsibility insurance or some other evidence of economic responsibility in every state.

You, as a car owner, get on the hook personally for any kind of injury or home damages beyond the limits you picked. Your insurer won't pay even more than read more your limit. However liability protection will not pay to fix or change your auto. If you owe money on your car, your lending institution will certainly require that you acquire accident and detailed protection to safeguard its investment.

Here are some guidelines of thumb on guaranteeing any car: When the automobile is brand-new as well as funded, you have to have full insurance coverage. Keep your deductible manageable. When the automobile is settled, increase your deductible to match your offered cost savings. (Higher deductibles help reduce your costs)When you reach a point financially where you can change your car without the support of insurance policy, seriously think about going down detailed and also crash.

An Unbiased View of Car Insurance Prices - State Farm®

affordable insure insure low cost auto

affordable insure insure low cost auto

com's on-line auto insurance coverage calculator to get our referral of what automobile insurance protection you must acquire. It'll additionally recommend insurance deductible limits or if you need protection for uninsured motorist protection, medpay/PIP, as well as umbrella insurance coverage. Exactly how to obtain low-cost full insurance coverage car insurance policy? The most effective means to locate the most affordable full insurance coverage automobile insurance is to shop your protection with various insurers.

Here are a few suggestions to adhere to when shopping for economical full coverage vehicle insurance coverage: Make certain you are consistent when shopping your liability limitations. If you select in physical injury liability each, in physical injury obligation per accident and in home damage liability per accident, always shop the very same coverage degrees with other insurance firms.

These coverages are part of a complete insurance coverage package, so a costs quote will be needed for these protections. Both accident and detailed featured a deductible, so make sure always to pick the very same deductible when going shopping for protection (cheapest car insurance). Picking a higher insurance deductible will certainly push your premium lower, while a lower insurance deductible will result in a higher premium.

There are various other coverages that help comprise a complete coverage bundle. These insurance coverages vary however can include: Uninsured/underinsured motorist coverage, Accident protection, Rental repayment protection, Towing, Gap insurance policy, If you require any one of these extra protections, always pick the exact same insurance coverage levels and also deductibles (if they use), so you are contrasting apples to apples when buying a new plan.

Can I go down full coverage automobile insurance coverage? If you can handle such a loss-- that is, replace a taken or totaled car without a payment from insurance coverage-- do the mathematics on the possible cost savings as well as think about going down protections that no longer make sense.

Excitement About Car Insurance Prices - State Farm®

Dropping extensive as well as collision, she would pay concerning a year a cost savings of a year. Let's state her cars and truck deserves as the "actual cash money worth" an insurer would pay. If her cars and truck were totaled tomorrow as well as she still brought complete coverage, she would get a check for the vehicle's actual cash worth minus her insurance deductible.

Of course, the auto's worth goes down with each passing year, and so do the insurance coverage premiums. Full protection auto insurance Frequently asked question's, Just how much is complete protection insurance coverage on a new car?

Maine has the most affordable full auto insurance policy rate on the other end of the spectrum, with an ordinary premium of a year. How much is full protection insurance policy for 6 months?

If you are funding your car, your insurance company will likely call for that you lug minimal full coverage for financed car to safeguard their investment in your lorry - cheaper auto insurance. Expect you aren't carrying extensive or crash coverage and also your vehicle is ruined in a crash by an extreme climate occasion or various other risk.

vans liability car auto

vans liability car auto

Up until you own your car outright and can manage to fix or change it, if necessary, you ought to be lugging complete coverage insurance policy. What is thought about full coverage cars and truck insurance? Technically, there is no such point as a "complete insurance coverage" insurance policy. The term "complete insurance coverage" simply describes a collection of insurance policy protections that provide a wide range of securities, essentially, protecting your car in "complete. "While "full insurance coverage" can mean various things to various individuals, many motorists think about complete coverage auto insurance policy to include not only required state protections, such as obligation insurance however comprehensive and also accident coverages (cheaper).

Indicators on How Much Is Car Insurance Per Month In 2022? Get Tips For ... You Need To Know

Always ensure you are contrasting apples to apples when it involves protection degrees and deductibles (dui).

The ordinary yearly cost of automobile insurance in the united state was $1,057 in 2018, according to the current information offered in a record from the National Association of Insurance Commissioners. Understanding that statistic won't necessarily help you figure out just how much you will be paying for your own insurance coverage.

To much better recognize what you should be spending for auto insurance, it's best to find out regarding the means companies identify their prices. Keep checking out for an introduction of one of the most usual factors, and just how you can gain a few additional financial savings. Determining Typical Annual Cars And Truck Insurance Coverage Price There are a lot of factors that go right into identifying your cars and truck insurance policy rate.

Below are some vital elements that influence the typical price of car insurance in America.: Guys are generally related to as riskier motorists than ladies - affordable. The statistics reveal that ladies have fewer DUI occurrences than guys, in addition to less collisions. When females do obtain in a crash, it's statistically much less likely to be a major crash.

Something less obvious is at play below, too; if your state mandates particular standards for car insurance that are more stringent than others, you're likely to pay more money. Michigan, for instance, calls for locals to have unlimited life time individual injury defense (PIP) for accident-related clinical costs as a component of their car insurance coverage.

What Does Car Insurance Coverage Calculator - Geico Mean?

The second the very least pricey state was Maine, followed by Iowa, South Dakota, as well as Idaho.: If you are using your cars and truck as an actual taxi or driving for a rideshare service, you will certainly need to pay even more for insurance policy, and also you may need to pay for a various sort of insurance coverage completely.

: The length of your commute, how usually you utilize your auto, why you utilize your auto, and where you park all effect your premiums. If you have a long commute, you are subjected to the threats of the road for longer. If you drive regularly, you're revealed to the risks of the road extra frequently.

Constantly make sure you are comparing apples to apples when it pertains to protection levels and also deductibles (cheaper).

The ordinary yearly price of automobile insurance coverage in the U.S. was $1,057 in 2018, according to the most recent information offered in a record from the National Association of Insurance Policy Commissioners. Nonetheless, knowing that statistic won't necessarily help you figure out just how much you will be paying for your own coverage.

To better comprehend what you ought to be spending for auto insurance policy, it's ideal to find out about the method firms determine their prices - cheap. Keep reviewing for a summary of one of the most typical components, and how you can earn a few additional cost savings. Calculating Average Yearly Car Insurance Coverage Price There are a great deal of aspects that go right into establishing your car insurance coverage rate.

What's The Average Cost Of Car Insurance In 2020? - Business ... for Dummies

insurance insurance affordable auto insurance insurance company

insurance insurance affordable auto insurance insurance company

Here are some crucial elements that affect the typical expense of car insurance in America.: Males are typically considered as riskier motorists than ladies. The data reveal that women have fewer DUI incidents than men, in addition to fewer crashes. When women do enter a mishap, it's statistically much less most likely to be a significant accident.

Something less apparent is at play below, as well; if your state mandates specific standards for cars and truck insurance that are stricter than others, you're likely to pay more money. Michigan, for instance, requires citizens to have unlimited life time individual injury defense (PIP) for accident-related medical expenditures as a part of their automobile insurance. accident.

The second least pricey state was Maine, followed by Iowa, South Dakota, as well as Idaho.: If you are utilizing your cars and truck as a real taxi or driving for a rideshare service, you will certainly have to pay more for insurance policy, and you might need to pay for a various type of insurance coverage entirely - cheapest auto insurance.

https://www.youtube.com/embed/EGmQqEsa7Kg

, just how typically you use your auto, why you utilize your vehicle, as well as where you park all impact your premiums. If you drive extra frequently, you're subjected to the dangers of the road a lot more often.