What Does How Much Is Car Insurance? Average Costs, May 2022 Do?

Insurance coverage on a brand name brand-new car or a luxury SUV can be much costlier than insurance policy on a 10-year-old secondhand automobile. High worth cars are a lot more pricey to deal with if something breaks or if you get involved in a crash. If your car obtains completed or taken, the insurance provider needs to compensate you based upon the auto's current worth.

Exactly how to save money on car insurance premiums, Although automobile insurance can be pricey, there are several means that you can decrease your costs. Below are some options for getting a cheaper cars and truck insurance rate: Apply discounts, Almost every insurer supplies price cuts that can decrease your costs. Some price cuts are much more significant than others.

The precise cost savings vary by insurance policy business, but it is generally somewhere between 5-15%. If your insurance coverage price is extremely pricey, also a price cut of 5% can be worth it. Inspect your protection, The more vehicle insurance policy coverage you have, the higher your insurance coverage costs can be. The sort of coverage you choose likewise influences your insurance expenses.

You may already have roadside aid with your credit score card provider. Frequently asked inquiries, What is the finest automobile insurance firm? The finest car insurance policy firm for client solution could not be the best supplier for low-cost rates.

The age of your auto and also its worth, if it's financed, as well as what you want to be covered under your policy can aid you determine which automobile insurance coverage to pick. What is the ordinary auto insurance policy premium?

Our What Is A Car Insurance Premium? - The Hartford PDFs

This policy is an agreement between the driver and the insurer that secures the chauffeur from financial responsibility in case of a crash or theft. To see to it you are not paying too much for automobile insurance, it's complimentary to check online via Credible's partners. There are several aspects that affect the cost you pay on your automobile insurance premium.

Sort of vehicle, Your driving habits, Geographical place, Age as well as sex, Your credit rating, Kinds of protection, Restrictions and deductibles, Insurance policy prices differ based upon the type of cars and truck you have. Some autos are a lot more expensive to guarantee than others. The possibility of theft, expense of repair work, engine size, as well as safety document impact the cost. insured car.

A higher deductible normally suggests you pay much less on your premium. Utilizing a car insurance policy premium calculator can conserve you time and money prior to you make your choice.

In Texas, as an example, some insurance policy suppliers have actually outlined strategies to raise rates by approximately greater than 20%, according to the Texas Division of Insurance Policy. In Arizona one of the few states that do not need insurance companies to look for federal government authorization for walks major carriers Geico and Allstate have actually pushed up rates by 8% and 7%, respectively.

low cost suvs suvs risks

low cost suvs suvs risks

While area is an essential factor in determining premium prices, the Insurance policy Information Institute (III) has actually noted that vehicle drivers are likely to experience rate walks this year, despite where they live. "Automobile costs have actually not equaled inflation specifically when it involves automobile replacement component costs," claimed president Sean Kevelighan in a declaration - low cost auto.

The Ultimate Guide To Controlling The Cost Of Auto Insurance - Nj.gov

After these accidents occur, the case payouts are higher due in part to the higher cost of auto replacement components." The situation has motivated numerous motorists to look for methods to lower their costs - car insured. To figure out how this can be done effectively, Insurance policy Business took a look at the internet sites of a number of consumer money business for sensible tips as well as guidance.

Since each vehicle driver's account as well as circumstances are different, according to personal financing company Nerd, Purse, "no solitary insurer is the low-price leader for every person." It included that an insurance coverage provider that uses the cheapest policy for a single person may be one of the most costly choice for an additional in a different state.

The study discovered that in Florida, State Ranch's vehicle insurance premiums averaged $1,766 annually, which was the most affordable rate in the state for a motorist without an army link while Geico's ordinary price was $239 greater. The opposite was real in The golden state, where Geico used the most affordable average prices at $1,458, while State Farm's costs were $423 greater (affordable).

Geek, Purse likewise suggested that drivers think about neighborhood and also local insurance firms as these usually have greater consumer complete satisfaction rankings and also supply reduced prices compared to large gamers. Car insurance coverage companies offer a variety of discounts, which drivers can take benefit of to minimize their yearly costs. Drivers can usually get these via: Bundling of car policies with house owners' or renters' insurance Guaranteeing numerous vehicles in a single plan Maintaining a clean driving document Paying premiums in complete as opposed to month-to-month instalments Setting up protection as well as security functions Taking defensive driving programs Belonging to specialist companies or affiliate teams Maintaining good qualities for students Auto insurance provider also provide a variety of coverage alternatives that affect exactly how much costs will certainly set you back - affordable car insurance.

"You may be attracted to add on optional coverage yet staying with the fundamentals can greatly reduce your rates," the team wrote on its internet site. "For instance, you can eliminate or lower medical repayments protection. If you and your household are already covered by health insurance, you may not require to fret about this add-on (cheap).

Not known Facts About Average Car Insurance Cost (May 2022) - Wallethub

"It's a controversial problem in certain statehouses ... [] insurers will claim their studies show that if you're liable in your individual life, you're much less most likely to submit claims." An evaluation by Nerd, Pocketbook also found that having bad credit can enhance motorist's insurance coverage rates by numerous dollars a year contrasted with having good a credit report.

Obtain at least 3 different quotes to locate the best auto insurance rates (insurance affordable). The company warned, nevertheless, that what matches their friends may not be the ideal one for them, thinking about the differences in each person's profile as well as scenarios.

Exactly how can my credit score insurance rating advantage me? A credit-based insurance coverage rating enables insurers to quote the fairest, most suitable price for every customer.

insurance laws cars cheapest auto insurance

insurance laws cars cheapest auto insurance

What is a phenomenal life circumstance? We have an extraordinary life situation process that uses in all states. If your credit information has been directly affected by one of the following events, you may qualify for reconsideration of your premium.

Here are some reasons vehicle insurance coverage costs raise. Relocating to a residential area with a greater crime price, altering how frequently you drive and even vehicle parking your auto in a different way could result in increased costs; Influences most products you purchase, as well as lorries are no exception (car insurance). Because of this, it's typical for insurers to increase the cost of premiums to show the cost of automobiles.

The Main Principles Of Car Insurance Rates By Make And Model 2022 - Finder.com

It's a great suggestion to contrast plans when taking out or renewing car insurance coverage, as it might save you money. Our automobile insurance policy comparison service is cost-free, easy to utilize as well as offers you a variety of cars and truck insurance options in minutes. Why does my car insurance coverage seem costly compared to others?'Why is automobile insurance policy so expensive?' is a concern many drivers ask when it comes to securing their cars and truck.

car affordable affordable car insurance cars

car affordable affordable car insurance cars

You must understand that many states need obligation insurance protection on electric motor cars. Responsibility coverage pays for the damage you causeor are liable for if you are at-fault in an accident.

auto auto auto insurance affordable

auto auto auto insurance affordable

State regulations need individuals's automobile insurance policy to include responsibility coverage to protect others from problems triggered by a chauffeur's blunder. But, obligation insurance additionally safeguards the chauffeur who is at mistake. Without insurance coverage, an at-fault vehicle driver might Go to this website be eliminated monetarily after paying for damages to residential property or injury to an individual.

This is why carrying the minimum state needed amount of obligation insurance might not be wise. You pay even more, but if the injuries to someone surpass the quantity of insurance you lug, you will certainly have to pay cash money for the remainder.

According to our research study, the national ordinary depictive car insurance policy price is $1,442 each year. That quantity is based on information from 9 of the largest auto insurer in the country. That being stated, numerous aspects establish a chauffeur's car insurance costs, so the information in our study might not be indicative of the rate you pay.

See This Report about Car Insurance Rates By State 2022: Most & Least Expensive

Modern, Farmers, as well as Allstate have average prices that are a lot more pricey than the general nationwide average. We did a comprehensive analysis of vehicle insurance policy prices for vehicle drivers across the country to find the cheapest insurance providers in each state. The rates revealed here are an easy typical taken from depictive driver profiles, so your prices will certainly differ.

Even within the exact same state, you may locate that prices change in different ZIP codes - insurance affordable.

It can be a headache searching for automobile insurance coverage. It's tough to recognize who to depend on and also be confident you have the coverage you needlet alone at an excellent rate. Nevertheless, you want a reasonable rate that is satisfied you, right? GEICO suches as to be clear - suvs. You ought to know how we establish auto insurance policy rates.

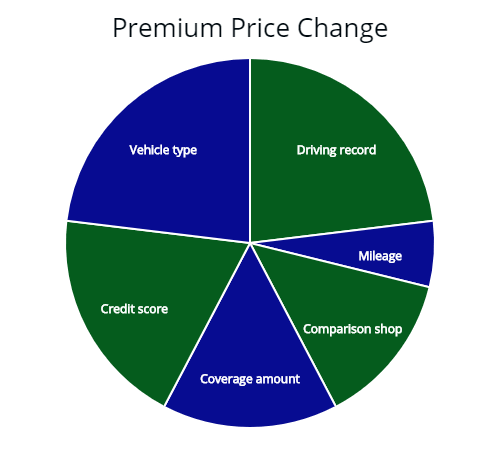

Know the aspects influencing automobile insurance coverage premiums and also learn just how to decrease insurance coverage costs. You pay one amount for cars and truck insurance policy, your buddy pays an additional and your neighbor pays still another amount. What gives? A lot of insurance coverage business consider a number of vital aspects to compute how much you'll wind up spending for your automobile insurance - credit score.

The reverse can use for less risk-free trips. Some insurance firms boost premiums for cars much more susceptible to damage, resident injury or burglary and also they lower rates for those that get on far better than the standard on those procedures (money).

The Best Strategy To Use For What Is A Car Insurance Premium? - The Hartford

So before you head to the car dealership, do some research on the car you intend to acquire. Does the lorry that has captured your eye have solid safety scores? Is this details version typically swiped? Recognizing the response to a couple of straightforward concerns can go a lengthy means toward maintaining your prices low.

, city chauffeurs pay more for vehicle insurance policy than those in tiny towns or rural areas.

If you've been accident-free for a lengthy duration of time, don't obtain contented (trucks). Stay careful and also keep your good driving habits. If you are insured as well as accident-free for 3 years, you likely get approved for a State Farm accident-free savings. As well as although you can not rewrite your driving history, having a mishap on your document can be a vital suggestion to constantly drive with caution and treatment.

Your credit scores history Particular credit details can be anticipating of future insurance policy cases. Where suitable, numerous insurance provider use debt history to assist determine the expense of auto insurance policy. Preserving good credit rating may have a positive effect on your cars and truck insurance policy expenses. Your age, sex and marital standing Accident rates are greater for vehicle drivers under age 25, particularly solitary men.

accident car insurance low cost auto car insurance

accident car insurance low cost auto car insurance

https://www.youtube.com/embed/-QfmcoYYb5E

If you're a pupil, you could be in line for a price cut. Many vehicle insurance companies give discount rates to trainee motorists that keep good grades. What are ways to assist reduced cars and truck insurance policy costs? Dropping unneeded protection, raising your insurance deductible or lowering protection limitations may aid lower insurance coverage prices. Your insurance representative can share the pros and disadvantages of these options.See your local agent for a complete listing of price cuts. Using one insurer for several insurance plan can lower your complete costs. Incorporating the purchase of an auto plan with the acquisition of a residence policy, occasionally called packing, can save you money. As constantly, it's a great concept to chat to your State Ranch representative concerning what plans are best for you and your scenario.