The Greatest Guide To Auto Insurance - Georgia Office Of Insurance And Safety Fire ...

A typical complete insurance coverage insurance plan will not cover you and your automobile in every situation. It has exemptions to details occurrences. IN THIS ARTICLEWhat is full protection auto insurance? There is no such point as a"complete coverage"insurance policy; it is just a term that refers to a collection of insurance coverage coverages that not just consists of liability coverage yet accident and also extensive as well. What is thought about full protection insurance coverage to one chauffeur might not coincide as even an additional driver in the same house. Preferably, complete insurance coverage means you have insurance coverage in the types as well as amounts that are ideal for your earnings, assets and risk profile. The factor of all kinds of auto insurance coverage is to maintain you from being economically ruined by a mishap or occurrence. Fees additionally differ by hundreds or perhaps thousands of bucks from company to firm. That's why we constantly recommend, as your primary step to saving money, that you contrast quotes. Here's a state-by-state contrast of the ordinary annual cost of the following insurance coverage degrees: State-mandated minimal liability, or, simplistic insurance coverage needed to lawfully drive an automobile, Full coverage obligation of$100,000 each harmed in an accident you trigger, approximately$300,000 per accident, and $100,000 for home damage you create(100/300/100), with a$500 deductible for detailed and also crash, You'll see how much full insurance coverage auto insurance coverage expenses per month, as well as annually. The average yearly rate for complete coverage with higher responsibility restrictions of 100/300/100 is around $1,150 even more than a bare minimum plan. If you pick lower liability restrictions, such as 50/100/50, you can save but still have suitable security. The typical regular monthly expense to boost insurance coverage from state minimum to full protection (with 100/300/100 limits )has to do with$97, but in some states it's much less, in others you'll pay even more (cheapest). Your auto, up to its fair market price, minus your deductible, if you are at fault or the other chauffeur does not have insurance coverage or if it is ruined by an all-natural disaster or swiped (comp and crash) Your injuries as well as of your guests, if you are hit by a without insurance driver, approximately the restrictions of your uninsured driver plan (uninsured motorist or ). In reality, full protection vehicle insurance coverage have exclusions to particular occurrences - cheapest car. Each complete cover insurance coverage will have a listing of exclusions, indicating items it will certainly not cover. Competing or other rate competitions, Off-road use, Usage in a car-sharing program, Disasters such as battle or nuclear contamination, Damage or confiscation by government or civil authorities, Using your lorry for livery or shipment objectives; company use, Intentional damages, Freezing, Deterioration, Mechanical failure (commonly an optional insurance coverage)Tire damages, Items stolen from the car(those may be covered by your property owners or renters policy, if you have one )A rental vehicle while your very own is being fixed (an optional protection )Electronic devices that aren't completely connected, Customized parts and also equipment(some percentage may be defined in the policy, but you can generally add a motorcyclist for higher amounts )Do I need full coverage auto insurance? You're needed to have liability insurance coverage or some various other proof of financial obligation in every state. You, as an auto owner, get on the hook directly for any injury or residential or commercial property damage beyond the limitations you chose. Your insurer will not pay greater than your limit. But responsibility insurance coverage will not pay to repair or replace your car. If you owe cash on your lorry, your lender will require that you buy collision and comprehensive coverage to protect its financial investment. Below are some guidelines of thumb on insuring any cars and truck: When the car is brand-new as well as funded, you have to have full protection. Maintain your insurance deductible convenient. When the auto is paid off, raise your deductible to match your available cost savings.(Higher deductibles aid decrease your costs )When you get to a point economically where you can replace your auto without the support of insurance policy, seriously take into consideration dropping detailed as well as accident. com's on-line automobile insurance policy calculator to get our suggestion of what car insurance protection you must purchase. It'll likewise suggest deductible limits or if you require coverage for without insurance driver coverage, medpay/PIP, and also umbrella insurance. low cost. Just how to get cheap complete coverage auto insurance? The very best means to find the most affordable full insurance coverage car insurance policy is to shop your insurance coverage with different insurance providers (cheaper).

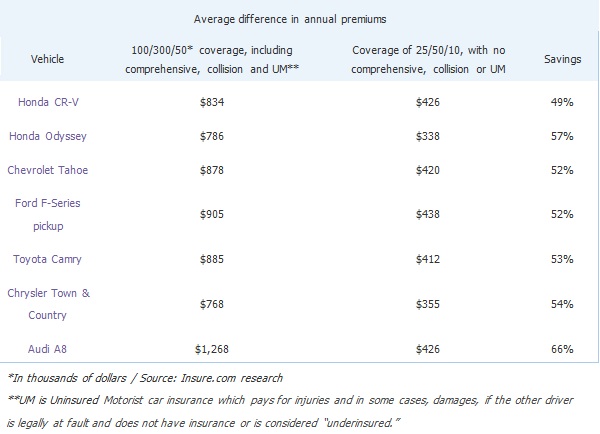

Here are a couple of tips to follow when More help purchasing economical full coverage automobile insurance coverage: Make certain you are constant when shopping your responsibility limitations. If you choose in bodily injury responsibility per person, in bodily injury obligation per accident as well as in residential property damages obligation per accident, constantly go shopping the exact same insurance coverage degrees with other insurers. These protections are part of a full insurance coverage bundle, so a costs quote will certainly be needed for these protections. Both collision and comprehensive come with an insurance deductible, so be sure constantly to choose the same insurance deductible when purchasing coverage. Choosing a greater deductible will certainly push your premium lower, while a reduced insurance deductible will lead to a higher costs. dui. There are other protections that help make up a complete protection package. These insurance coverages vary but can consist of: Uninsured/underinsured motorist insurance coverage, Personal injury protection, Rental reimbursement protection, Towing, Space insurance coverage, If you need any one of these extra protections, constantly select the same protection levels and deductibles( if they use), so you are contrasting apples to apples when looking for a new plan. Going down comprehensive as well as collision, she would pay about a year a savings of a year. Allow's say her vehicle deserves as the" real cash money worth "an insurance coverage company would pay - cheapest auto insurance. If her car were completed tomorrow and she still carried complete protection, she would obtain a look for the automobile's real cash worth minus her insurance deductible (auto). Of program, the auto's value drops with each passing year, therefore do the insurance policy premiums - low cost.

liability credit score car cheap

liability credit score car cheap

cheap insurance car insurance vehicle cars

cheap insurance car insurance vehicle cars

credit score insured car low cost credit

credit score insured car low cost credit

auto insurance cheapest money cheaper car

auto insurance cheapest money cheaper car

Full insurance coverage cars and truck insurance policy FAQ's, How much is full insurance coverage insurance coverage on a brand-new auto? Just how much is full coverage insurance for 6 months? Complete protection six-month prices will vary throughout states as well as different other factors however the nationwide average for a six-month complete coverage plan is - cheaper car.

https://www.youtube.com/embed/4aX_DGKKD5U

The term"complete protection" simply refers to a collection of insurance coverage coverages that provide a broad range of protections, essentially, shielding your automobile in"full."While"full insurance coverage"can imply various points to various people, the majority of drivers vehicle drivers take into consideration coverage auto automobile to include not only mandatory compulsory coveragesProtections such as liability insurance insurance coverage comprehensive extensive as well as coverages. While liability, comprehensive, and accident protection can secure you in lots of situations, you can have even much better protection if you consist of: Uninsured/Underinsured Vehicle driver Security This coverage aids you if you obtain right into a crash with an individual that has no insurance or doesn't have sufficient protection on their policy to accomplish the insurance claim.