Unknown Facts About Full Coverage Auto Insurance: What Is It? - The Balance

Medical or No-Fault Insurance coverage We provide it in all states where we work, yet it varies. See your agent for details. Without insurance as well as Underinsured Not every person is as accountable as you. This insurance coverage safeguards you and also your travelers if physical injury is brought on by a vehicle driver without ample cars and truck insurance coverage.

With our replacement expense insurance coverage, your automobile can be approximately 4 model years old (five in select states) and also still be eligible for substitute expense coverage (credit score). Since remaining in a crash should not mean you need to give up on having a brand-new automobile. Driveology Your excellent driving can help you make discount rates on your automobile insurance coverage rates.

Young Motorist Security Program The flexibility of a driver's license also brings duty. Our Young Motorist Safety Program is created to aid young vehicle drivers stay secure on the road.

In a lot of cases, there are no out-of-pocket expenses as well as we make it simple to return when driving. One phone call to our Claims Center starts the process to obtain you back when traveling: 1-800-226-6383. insurance. Phenomenal Claims Solution If you're ever before included in a mishap, you do not require to fret about going back as well as forth with your insurance provider over your case.

Unknown Facts About Average Car Insurance Costs In March 2022 - Policygenius

perks cheap cars insurance affordable

perks cheap cars insurance affordable

With an insurance claims contentment rate over 90 percent, we verify time and also once again that we have what it requires to smooth the bumps you'll experience on life's roadways. Ways to Save The best insurance coverage requires to be budget-friendly. We provide discount rates to help you save, and to maintain protection budget friendly.

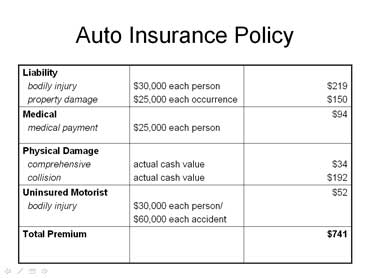

A car insurance coverage can consist of numerous different type of coverage. Your independent insurance policy agent will give expert suggestions on the type and amount of automobile insurance policy coverage you should need to fulfill your private requirements as well as conform with the regulations of your state (cheapest car insurance). Below are the primary type of coverage that your plan might consist of: The minimal protection for bodily injury differs by state as well as may be as reduced as $10,000 per person or $20,000 per accident.

If you harm a person with your vehicle, you can be demanded a great deal of money. The quantity of Responsibility coverage you carry should be high sufficient to safeguard your possessions in case of a mishap - cheapest. Many experts suggest a limitation of at the very least $100,000/$300,000, however that might not be sufficient.

If you check here have a million-dollar house, you could lose it in a legal action if your insurance protection wants (car). You can obtain added coverage with a Personal Umbrella or Individual Excess Responsibility policy. The greater the value of your assets, the extra you stand to lose, so you need to get responsibility insurance proper to the worth of your assets.

Our Travelers Insurance: Business And Personal Insurance ... Statements

You do not need to identify just how much to buy that relies on the vehicle(s) you insure. But you do require to make a decision whether to purchase it as well as how huge a deductible to take. The higher the deductible, the reduced your costs will certainly be - cheapest auto insurance. Deductibles usually range from $250 to $1,000.

If the vehicle is just worth $1,000 as well as the insurance deductible is $500, it may not make sense to purchase crash protection. As with Accident protection, you require to select an insurance deductible - credit.

cheaper cars cheapest auto insurance cheapest auto insurance cheapest car insurance

cheaper cars cheapest auto insurance cheapest auto insurance cheapest car insurance

Comprehensive protection is usually offered along with Collision, and both are often described together as Physical Damages insurance coverage - vans. If the vehicle is rented or financed, the leasing business or loan provider might need you to have Physical Damages coverage, despite the fact that the state regulation may not need it. Covers the expense of healthcare for you as well as your travelers in the event of an accident.

For that reason, if you select a $2,000 Medical Expenditure Limit, each guest will have up to $2,000 coverage for medical insurance claims arising from a mishap in your automobile. If you are associated with a mishap as well as the various other driver is at fault however has insufficient or no insurance, this covers the void between your expenses as well as the various other vehicle driver's insurance coverage, approximately the limitations of your insurance coverage.

Excitement About How To Get A Salvage Title Cleared? : Faq Answered » - Way

The restrictions required and also optional limitations that might be offered are established by state regulation. cheaper car insurance. This protection, needed by law in some states, covers your medical costs as well as those of your guests, no matter who was in charge of the accident. The limitations needed as well as optional limits that may be offered are established by state law.

How much automobile insurance policy do you need? The solution depends on a variety of variables, consisting of where you live, how much your auto is worth, as well as what various other properties you need to shield. Below's what you need to understand - low cost. Trick Takeaways A lot of states need you to contend least a minimum quantity of insurance coverage for any injuries or residential or commercial property damage you cause in a crash.

accident credit cheapest car affordable

accident credit cheapest car affordable

Comprehensive coverage, also optional, protects versus various other threats, such as theft or fire. Without insurance motorist protection, necessary in some states, protects you if you're hit by a chauffeur who does not have insurance coverage. Exactly How Auto Insurance Works A vehicle insurance plan is in fact a bundle of several different kinds of insurance coverage. automobile.

If you have your house or have a considerable amount of cash in savings, a pricey crash might place them at risk. In that case, you'll wish to purchase more protection. The not-for-profit Consumers' Checkbook, to name a few, suggests purchasing coverage of at least 100/300/50, just in instance. The distinction in cost in between that protection as well as your state's minimum will probably not be quite.

All about Welcome To Bristol West Insurance Group

It's represented on your policy as the 3rd number in that sequence, so a 25/50/20 plan would provide $20,000 in protection. Some states require you to have just $10,000 and even $5,000 in home damages liability insurance coverage, however $20,000 or $25,000 minimums are most common. Once more, you might wish to get more protection than your state's minimum.

A generally suggested level of home damage insurance coverage is $50,000 or even more if you have considerable possessions to safeguard. Clinical Settlements (Med, Pay) or Injury Protection (PIP) Unlike physical injury liability coverage, clinical payments (Medication, Pay) or injury security (PIP) covers the expense of injuries to the chauffeur and any type of passengers in your auto. cheap auto insurance.

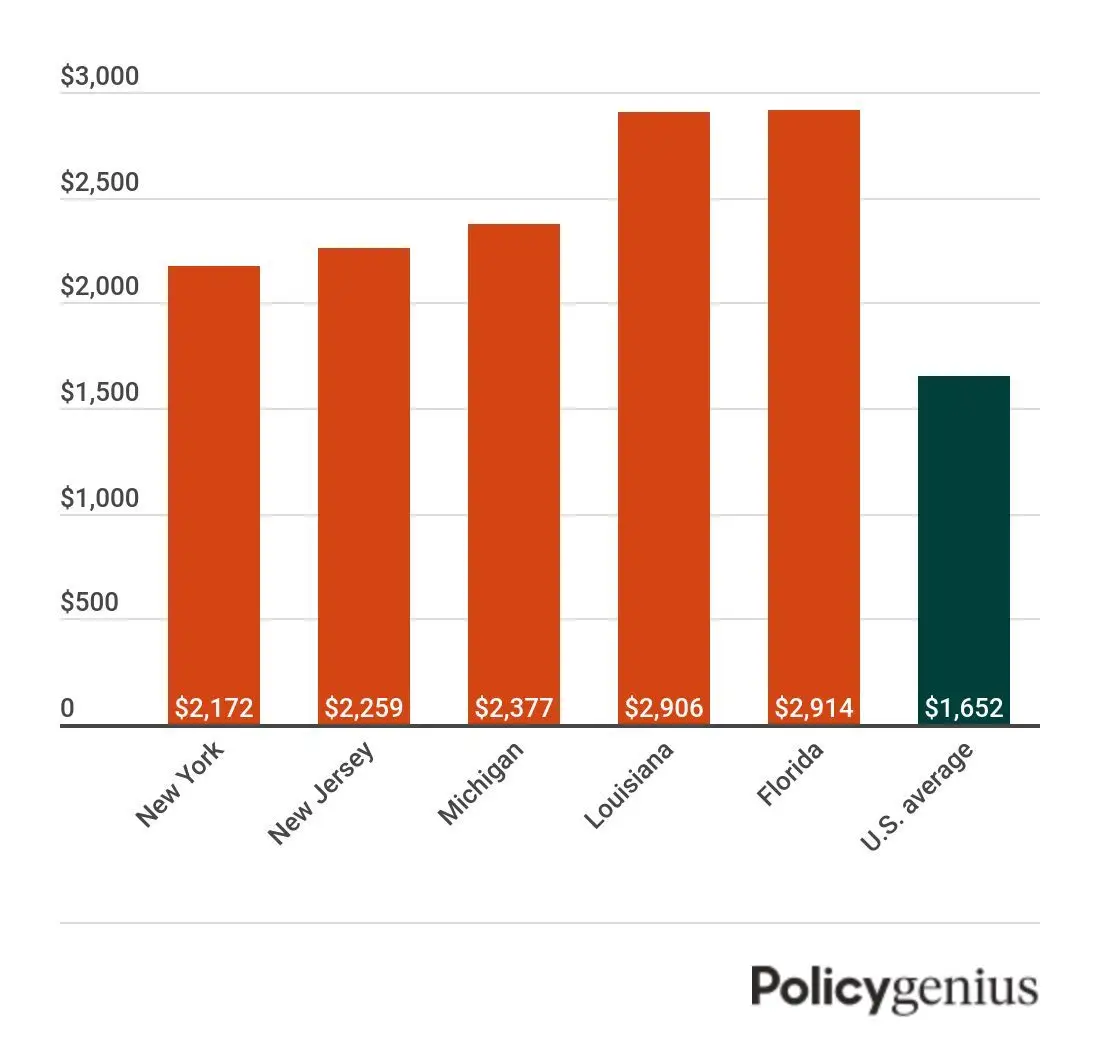

Whether medical settlements or PIP coverage is mandatory, optional, or even available will certainly depend on your state. In states with no-fault insurance laws, such as Florida and also New York City, PIP coverage is obligatory. In Florida, for instance, chauffeurs need to carry at the very least $10,000. In New York, the minimum is $50,000.

If you don't have medical insurance, nonetheless, you might want to buy much more. That's specifically true in a state like Florida, where $10,000 in coverage might be insufficient if you remain in a major mishap. Accident Protection Collision coverage will certainly pay to repair or change your auto if you're associated with an accident with an additional car or hit some various other item.

The smart Trick of How Much Is Car Insurance In California: Average Cost (2022) That Nobody is Discussing

accident insurers automobile dui

accident insurers automobile dui

If you have a car lending or are renting the car, your lending institution might need it. When you have actually settled your finance or returned your leased cars and truck, you can go down the coverage. Even if it's not called for, you may wish to get accident protection. For example, if you would certainly have difficulty paying a big repair work expense out of pocket after a mishap, crash coverage might be great to have.

cheapest car insurance affordable dui insure

cheapest car insurance affordable dui insure

The cost of collision insurance coverage is based upon the value of your automobile, as well as it usually includes a deductible of $250 to $1,000. So if your cars and truck would certainly set you back $20,000 to change, you would certainly pay the initial $250 to $1,000, relying on the deductible you picked when you got your policy, and the insurance firm would certainly be liable for as high as $19,000 to $19,750 after that.

In between the cost of your yearly costs as well as the insurance deductible you 'd have to pay out of pocket after an accident, you could be paying a lot for very little coverage (cars). Also insurer will certainly inform you that going down collision coverage makes feeling when your auto is worth much less than a few thousand dollars.

As with extensive insurance coverage, states do not require you to have accident coverage, yet if you have an auto lending or lease, your loan provider might need it. And also again, when you've paid off your financing or returned your rented vehicle, you can go down the protection.

What Is Full Coverage? What Does It Cover? - Mapfre ... - An Overview

You'll additionally wish to take into consideration just how much your car deserves compared to the expense of covering it year after year. Uninsured/Underinsured Driver Protection Even if state legislations need drivers to have liability insurance coverage, that doesn't indicate every chauffeur does. Since 2019, an approximated 12. 6% of driversor regarding one in eightwere without insurance.

That is where this sort of protection is available in. It can cover you and also relative if you're wounded or your vehicle is damaged by an uninsured, underinsured, or hit-and-run motorist. Some states need drivers to carry uninsured vehicle driver coverage (). Some additionally call for underinsured vehicle driver coverage (UIM). Maryland, for instance, requires vehicle drivers to lug uninsured/underinsured motorist bodily injury responsibility insurance coverage of at the very least $30,000 each and also $60,000 per accident.

If your state needs uninsured/underinsured motorist insurance coverage, you can purchase greater than the called for amount if you desire to. You can likewise purchase this coverage in some states that do not need it. If you aren't required to get uninsured/underinsured driver protection, you may intend to consider it if the protection you currently have would certainly want to pay the costs if you're associated with a major mishap.

Various Other Kinds of Coverage When you're shopping for automobile insurance, you might see a few other, absolutely optional types of coverage. Those can include:, such as towing, if you have to rent a vehicle while your own is being repaired, which covers any type of distinction between your vehicle's cash value and also what you still owe on a lease or loan if your cars and truck is a total loss Whether you need any one of those will depend on what other resources you have (such as subscription in a car club) and also just how much you might pay for to pay out of pocket if you must. cheap.

The Ultimate Guide To Welcome To Bristol West Insurance Group

Whether to purchase greater than the minimum needed insurance coverage and also which optional sorts of protection to consider will certainly depend on the properties you require to safeguard as well as exactly how much you can manage to pay. Your state's automobile division internet site ought to describe its demands and also may provide various other advice particular to your state. prices.

Full insurance coverage implies the vehicle driver desires more than simply responsibility protection. Full coverage consists of not just comprehensive and also accident insurance, yet uninsured or underinsured motorist insurance coverage.

There are as well numerous without insurance or underinsured drivers when driving, as well as obtaining into a crash with one can truly hurt you financially without this kind of insurance coverage. How much protection you'll need depends upon your individual situation - insured car. If you have properties, such as a home or financial investments, you desire to make certain you have enough insurance coverage in case of a severe collision.

If you do not have much in the way of assets, you won't require as much insurance coverage, but you need to lug the minimum amount of insurance needed to lawfully operate a vehicle in your state.

Our How Much Does Car Insurance Cost? Ideas

https://www.youtube.com/embed/g-2kH-Ru09EHow Much is Full Coverage Cars And Truck Insurance in California? In order to get the finest automobile insurance coverage in The golden state, also known as low-cost vehicle insurance policy that likewise keeps you well secured on the roadway, we advise complete insurance coverage cars and truck insurance coverage, which has an ordinary The golden state auto insurance coverage price of $142 each month or $1,700 each year. car insured.